A tantrumless taper? Federal Reserve remarks barely cause a stir

Last week the Federal Reserve Bank of Kansas City gathered online central bankers, policymakers, academics and economists from around the world for its annual Jackson Hole symposium. These meetings are generally worth paying attention to, as they often reveal important decisions concerning U.S. monetary policy. But this meeting may have been especially significant, due in part to the number of consecutive CPI prints above the already-inflated projections from early in the year.

The economy is cooking, no doubt—and the question on the minds of investors and policy-makers alike is whether or not it’s overcooking.

This question is clearly on the mind, too, of chairman Jerome Powell, whose position is up for reappointment in October of this year. In his summary address following the event, he articulated both last year’s policy and hinted changes likely on the horizon.

“We have said we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price-stability goals,” he said in his virtual address to the committee. “My view is that the substantial-further-progress test has been met.”

Powell insinuated a slowdown of bond purchases could be in store toward the end of 2021, a reversal of its recent quantitative easing policy.

A similar announcement by Federal Reserve Chair, Ben Bernanke, was made in 2013, following what was deemed to be a sufficient recovery from the 2008 financial crisis. That announcement created a panicked reaction in the market that resulted in a spike in U.S. Treasury yields, and is viewed by many to have measurably stunted economic growth in the years following, despite none of the policy actually being implemented. This backlash would come to be known as a taper tantrum.

No such panic occurred following Powell’s remarks last Friday. The deceleration in bond purchases would not necessarily coincide with increased interest rates, he said, and markets appeared to take him at his word.

“The timing and pace of the coming reduction in asset purchases,” Powell went on, “will not be intended to carry a direct signal regarding the timing of interest rate lift-off, for which we have articulated a different, and more stringent test.”

I suppose we will find out what that test is in the coming months.

***

For more insight, I turned to EdgeRock Portfolio Manager and Chief Compliance Officer, Rob Foss, to help us understand what just happened and how these decisions might affect investors.

Rob, I’m pretty sure a tapering announcement was just made, and yet no discernible tantrum occurred in its wake. As both a financial professional and the father of two young children, can you explain to us how this announcement went so smoothly? What’s changed since 2013?

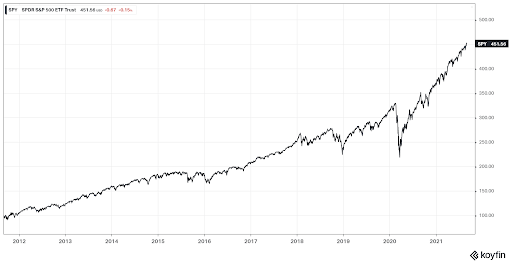

I think everyone needs to remember the environment we were in coming out of the Great Recession. Monetary policies enacted were unprecedented. Market participants thought that the economy and equity markets would crumble in the face of rising interest rates as the FED eased off super accommodative policies. Ultimately the economy was on solid enough footing and could handle the rise in rates making the “taper tantrum” unjustified. While it is interesting to recall, this is what the SPY looks like since then:

While it was a non-event in my view (supported by the chart above), the taper tantrum is still fresh in everyone’s minds. Ultimately, markets still could sell off as the FED tightens. However, I think FED actions are very well communicated to market participants and most probably believe that when the FED starts to tighten, monetary policy will still be supportive to the economy and financial markets.

The Federal Reserve is still seems to be expressing a fair amount of caution going forward. Despite recent jumps in employment numbers and stabilizing core inflation numbers, the consensus still appears to be “foot on the gas,” even if they’re no longer gunning it at 8000 RPM. What do you think we’ll need to see before interest rates creep up? What risk is there to investors if inflation remains elevated throughout 2021—or beyond?

Short-term rates are set by the Federal Reserve. Those won’t really move until the FED funds rate rises off of zero. Long-term rates are determined by investor sentiment and expectations. These rates will most likely rise when investors regain full confidence in the on-going recovery and sell out of the short-term treasury market. This selling will increase interest rates. At EdgeRock, we have always believed that the recent rise in inflation is caused by both permanent and transient factors. Our partners at First Trust share this belief and their economist team put out probably the best example to illustrate why it’s both.

This is their example: Say the economy is made up of 10 apples that are priced at $1 each. Total economic output is $10. Now, say that the total money supply increases by 30%, which will raise the price of each apple to $1.30. This brings output to $13. The pandemic halves the supply of apples, each apple now costs $2.60 so output still equals $13. In the end, transient factors will go away and the supply of apples will return to normal (10). Each apple will still cost 30% more even when supply chains are fixed. I will get you a citation tomorrow morning.

I think inflation will affect consumers and the economy as a whole, but I’m not sure if we are going back to the 1970s. Or at least not yet.

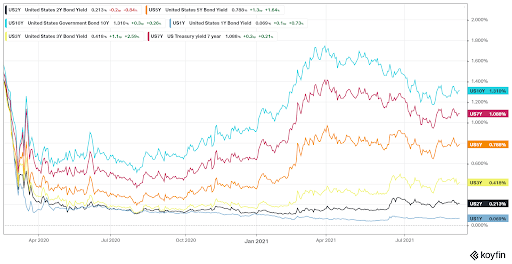

We heard a lot of talk this summer about skyrocketing bond yields. Ten-year treasuries seem to have normalized after a steady Q1 climb. What are we seeing here? And should investors be concerned about yields taking off again?

I think the direction of the 10-year UST depends on how investors feel about future economic growth and the ongoing summary. The chart below shows a change in yield over the past year and does a good job illustrating what happened earlier this year when the outlook was good versus more recent views, which are more muted. Theory teaches us that interest rates become detrimental to the economy and financial markets when they over take growth rates. I think we are a very long way off from that occurring.

While monetary policy matters, it’s clearly not the only thing influencing the market right now. What else are you observing that’s worth paying attention to?

Earnings. Always earnings. Equity market valuations in the intermediate to long-term time horizons are predominately based on corporate earnings and the outlook for those earnings. For the most part, companies are healthy because consumers are still spending money. We will be pretty busy looking at the commentary and outlook offered by Q4 earnings, which start in earnest in mid-October.

EdgeRock Wealth Management, LLC. is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training.

Information presented herein are for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account.

EdgeRock Wealth Management, LLC. links to third-party articles to assist users in locating information on topics that might be of interest to them. Information presented has not been verified and is not guaranteed, nor can we attest to the accuracy of information provided. Linking to an article or web site does not constitute a representation of the services offered by our firm nor does it constitute an endorsement by our firm of the sponsors of the site or the products presented on the site. However, EdgeRock Capital, LLC currently uses exchange traded funds (ETFs) that are actively managed by First Trust in our internally managed strategies. Additionally, we use commentary and research provided by First Trust for investment analysis. No consideration of any kind has been paid by either party for referencing this commentary. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation.

EdgeRock Wealth Management does not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Newsworthy

Newsworthy

Newsworthy

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.