Don’t Fear the Buffett Indicator

By Rob Foss

Chief Investment Officer

EdgeRock

With the S&P 500 up more than 28 percent since the end of October 2023 (its best first quarter since 2019), it’s had clients asking, “Where are markets going from here?” to which we must humbly respond, “We don’t know because we can’t predict the future.”

This isn’t to say that our experience can’t guide our thinking. Like other investors and wealth managers, we look at metrics and data to understand what current conditions are like relative to other time periods.

For example, while the price-earnings ratio can be used for a single stock, it can also be used for a stock market index. The current price-earnings ratio of the S&P 500 is about 23x, which compares to a long-term average of just north of 15x.

That’s pretty high in historical terms.

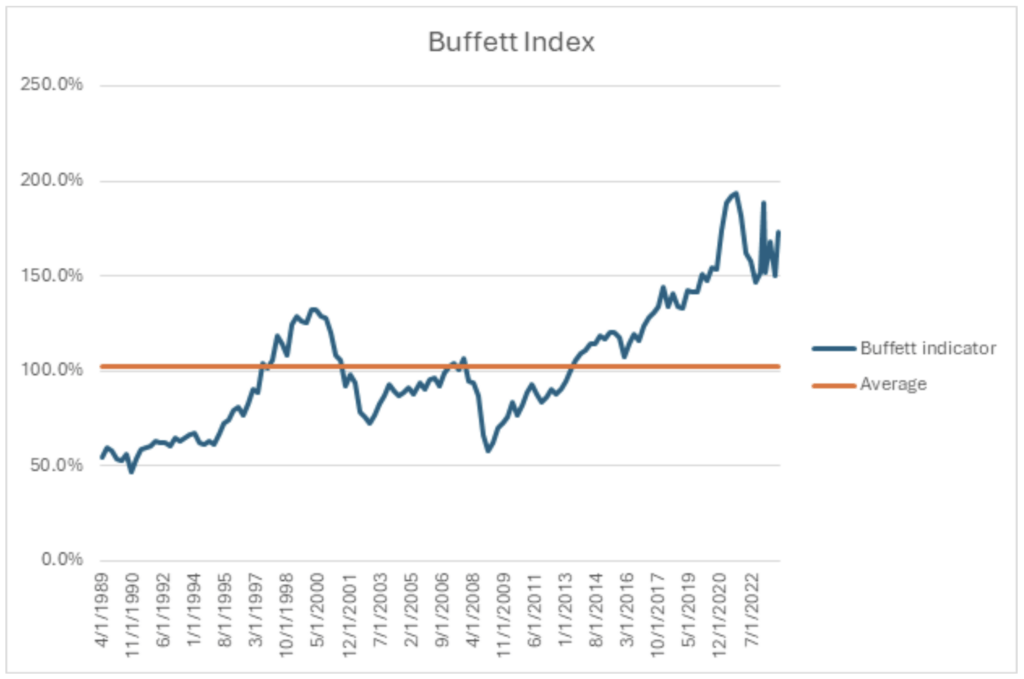

Another metric, the Buffett Indicator, created by the illustrious Warren Buffett, takes the value of all public US stocks (via the Wilshire 5000 index) and divides it by Gross Domestic Product. If the result of this fraction is greater than one, it means the stock market is overvalued. If the resulting fraction is less than one, the stock is undervalued. Simple enough, right?

Today, the Buffett Indicator sits around 1.9, which is nearly as high as it’s ever been.

Indicators matter—but not in isolation

While one could use a high Buffett Indicator as a reason to justify selling most if not all risky assets in a portfolio, we believe making decisions about an investment portfolio requires considering many other factors.

Momentum (both upward and downward) is a feature of stock markets. This means that the stock market can be perceived by the Buffett Indicator as overvalued for long stretches of time.

But if someone sold their entire stock portfolio the last time the Buffett Indicator was below one—all the way back in July of 2013—they would have missed out on nearly 300 percent in stock market gains. No one wants that, right?

For most people, making investment decisions based on the Buffett Indicator isn’t an advisable portfolio strategy.

One could argue that U.S. businesses are more valuable than in the past and, therefore, deserve higher valuations than the average suggests. We can point to rising revenues, margins, and shareholder returns as evidence. This data suggests U.S. corporations might be more productive than they’ve ever been. How?

One reason might be the internet, which has been a boon to a large portion of the economy—and we might be on the precipice of another productivity leap with generative artificial intelligence.

What are these metrics really telling us?

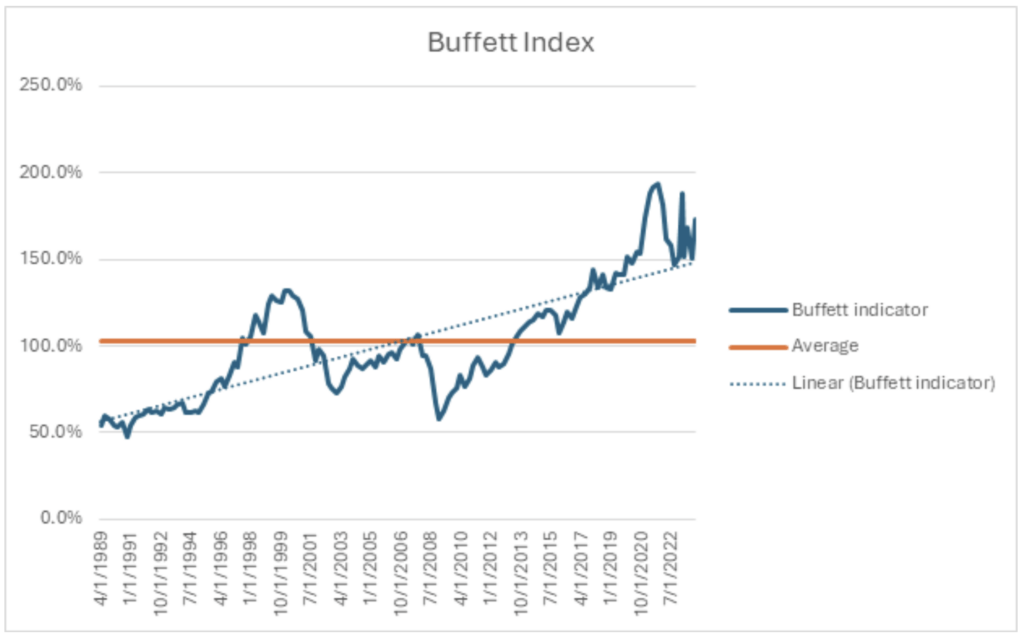

Maybe the better way to view the Buffett Indicator is to view it with a trend line. If we do this, U.S. stocks are still a bit overvalued, but nowhere near the overvaluation levels indicated by that 1.9 headline number alone.

We prefer this conclusion as the headline valuation numbers are dominated by the largest companies and there are still pockets of relative value in the U.S. stock market. This is evidenced by small capitalization stocks trading near 20-year lows relative to the S&P 500 on a trailing price to earnings.

When headline valuation numbers are indicating overvalued levels, discipline becomes even more important. By discipline we mean placing even more scrutiny on the assumptions and reasons why certain positions and strategies are held within a portfolio.

Discipline also means holding to allocation position limits, which should be well-diversified by including alternative asset classes and cash for opportunities that may present themselves. The stock market is not on sale, but that does not mean there is reason to panic.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Newsworthy

As the Ticker Turns

Newsworthy

As the Ticker Turns

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today or register to attend a seminar.