Recessions aren’t always bad

By Kyle O’Dell

Founder + CEO

In the face of an impending recession, the mood tends to be grim. Images of plummeting stock prices, surging unemployment rates, and shuttered businesses dominate headlines, painting a stark picture of the economic turmoil that often accompanies such times. However, a closer inspection reveals that recessions aren’t devoid of positive aspects.

One of the less appreciated benefits of a recession is its dampening effect on inflation and prices. During periods of economic expansion, the cost of living can soar, stretching household budgets that can be challenging for fixed incomes. When the economy contracts, that inflationary fever breaks, providing respite for those dismayed by escalating grocery bills, exorbitant hotel rates, or the eye-watering prices of concert tickets. For those with a frugal mindset, a recession can reset prices to more palatable levels.

Moreover, recessions serve as a necessary purge for the economy, clearing out excess and ensuring only the most resilient and efficiently run businesses thrive. As an economic reset button, they prompt consumers and corporations alike to bolster savings and curb excessive spending. Poor business concepts wither, while new and more robust ones emerge. This Darwinian process enhances the economic landscape, fostering a stronger, more sustainable environment for businesses to operate.

Another hidden advantage is downturns often spur a surge in innovation. Companies, striving to stay afloat, adopt cutting-edge technologies and streamline operations. There is typically an uptick in both government and private-sector investment in research and development during these periods, aimed at kick-starting economic growth.

Furthermore, recessions invariably compel governments to take action. Political pressure mounts to revitalize the economy, leading to proactive measures such as interest rate cuts by the Federal Reserve and stimulus legislation by Congress. Such policies can relieve debt burdens and spark fresh waves of entrepreneurial activity and innovation.

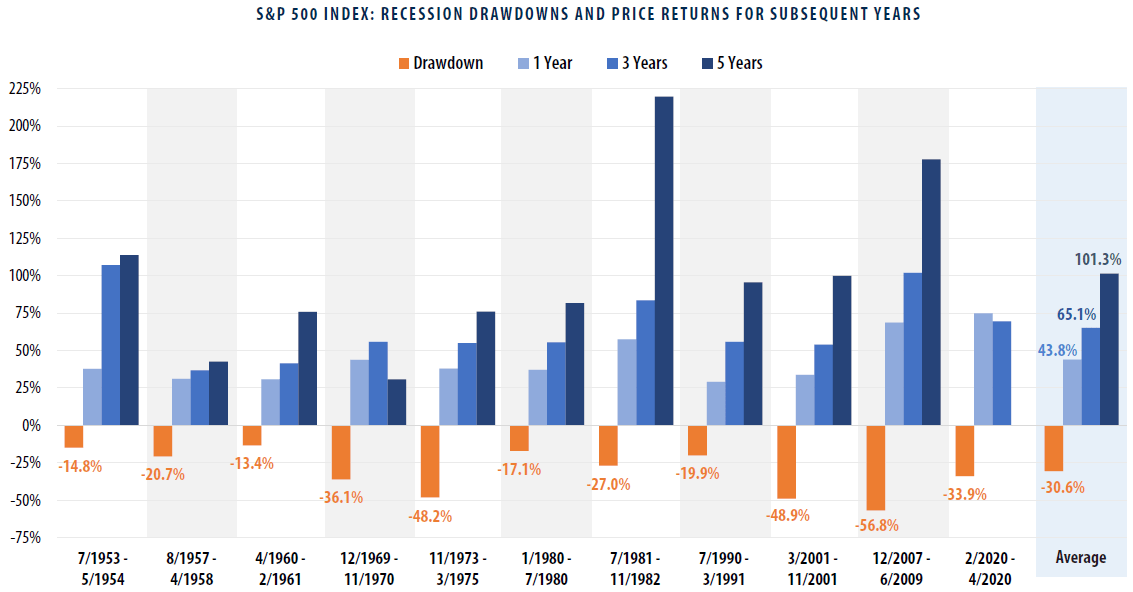

Investors, too, can find a silver lining in these seemingly bleak times. Historical analysis of the S&P 500’s performance surrounding recessions over the past 75 years demonstrates a pattern of remarkable resilience and growth following economic contractions. Despite an average immediate downturn of 30.6%, the index typically rebounds by 43.8% a year after a recession—and more than double five years later.

Additionally, there’s evidence to suggest recessions are becoming less protracted over time. Since 1854, the United States has weathered 34 recessionary cycles, with an average duration of 17.5 months. Post-1945, however, that average has decreased to just 11 months. This trend is a testament to the adaptive capacity of the economy, learning from each downturn to forge a more robust foundation for future prosperity.

In conclusion, while recessions are undoubtedly challenging, they also offer opportunities for recalibration and growth, both for individuals and the economy as a whole. As history shows, the economic pain is often followed by remarkable recovery, suggesting that even in the darkest financial times, there is light at the end of the tunnel.

Image courtesy of First Trust

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Newsworthy

Newsworthy

As the Ticker Turns

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.