Market Malaise: Was Q3 a reality check?

Ryan Murphy

Director of Marketing

EdgeRock Wealth Management

It’s been a while since we’ve seen months like September.

Domestic markets saw their biggest selloffs since March of 2020, and by the end, the S&P 500 was down more than 4.5 percent at last Thursday’s close. Those kinds of drops tend to inspire a lot of questions about the viability of stock investing in the immediate term and there’s no shortage of media outlets vying to provide us explanation.

We’ve heard disconcerting news about supply chains, Chinese real estate firms, the central bank and its bond purchases, labor shortages, infrastructure bills, and, of course, ongoing concerns about COVID-19, both domestically and how it’s affecting our trading partners across the globe.

Yeah—there’s a lot going on in the world, but that isn’t exactly a new phenomenon. Are any of these factors really the reason for the direction of the market in September? (Do global economies even pivot these days because of single, definable reasons?) And most importantly, does anything about September indicate what lies ahead?

As always, when I need answers, I go to my source down the hall, EdgeRock Portfolio Manager and Chief Compliance Officer, Rob Foss.

***

So we just saw the first noticeable tumble in the market since October of last year. How much of this can be explained by what we’re hearing in the news? And how much of it can be explained by annual Q3 malaise?

Ultimately, it is hard to say. On a daily basis, financial markets are driven by participant sentiment. As we have seen and all know, sentiment can shift in a hurry. However, it is only in hindsight that we know whether market shifts due to changing sentiment was or is justifiable. I think everyone needs to remember that markets are inherently volatile and downward movements are normal. While we are down more than 5% from the most recent high (as of the time of writing), the S&P 500 was up slightly for Q3.

Recent news is worth paying attention to, particularly if companies start revising their earnings forecast downwards. We are very interested in listening to management commentary that is usually released with corporate earnings, which are due to start in earnest next week. Financial markets also have a tendency to be self fulfilling prophecies in that selling activity in one sector or by a group of managers can trigger further selling activity by others. This is something else on which we are keeping a close eye.

No one can predict markets, but you do your best to be proactive with EdgeRock portfolios. What kinds of adjustments have you been implementing in recent months? And how do you now gauge these decisions amid recent sell-offs?

Recently we brought our cash position from one to five percent across all strategies. This was done to give us some more flexibility and our cash allocation in our models is subject to change in either direction based on what market data is telling us.

We look at data on a daily basis to see if our current positions are suitable in our never ending quest to try to optimize the risk vs. reward equation given different possible market environments. We could trade more often, but we usually don’t because data and sentiment are quick to change. It’s counterintuitive, but sometimes the best decision is to do nothing. Corrections of 10% or more are rarely detrimental to financial plans. It is really the significant drops of 20% or more that can hurt, which are the ones we are trying to protect against. Like you said, we can’t predict the future, but there is nothing showing up yet that is flashing extreme red.

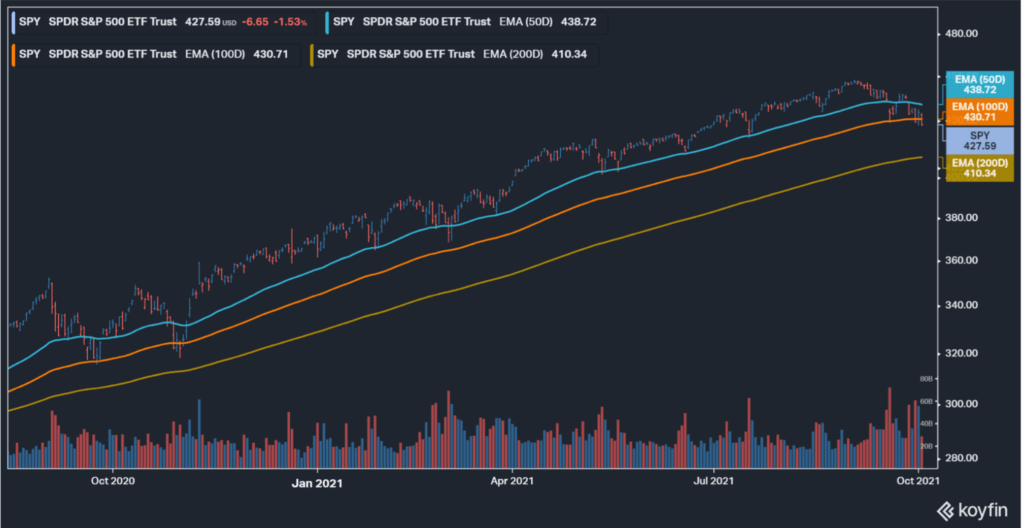

Over the past year, the S&P 500 (ticker SPY is what is shown below) has touched and even broken it’s 100-day moving average, but later recovered. It’s impossible to say whether this time will be different.

Much of the public commentary feels like it’s struggling to define what’s happening right now in markets. In a lot of ways, our situation feels like it should be a recession. Service, hospitality, and travel industries are still in disarray, marine ports are more backlogged than ever, we’ve experienced above-target inflation now for a number of months. These feel like factors that should be decimating the stock market, and yet the gains we’ve seen over the past year-and-a-half, across the board, are really unprecedented. Should we be experiencing this constant feeling of impending doom? Like all of it is too good to be true?

Financial markets tend to overreact to news and sentiment. In many ways, the covid-related sell off we saw in 2020 was an overreaction. It is also possible that markets were a little too exuberant earlier this year.

Markets fall on any given day if there are more sellers than buyers. It’s very simple, but yet true. It is the job of market pundits to assign a reason and make a story out of it. More times than not, they are simply reaching for an answer that is not really there. Financial markets have done well over the past year because interest rates are very low and corporate earnings (except for a few sectors) are very strong. The consumer is in good shape and still spending money. Remember, consumer spending drives the majority of our GDP. We will know more about what shape the average consumer is in when financials release earnings next week.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Newsworthy

Newsworthy

As the Ticker Turns

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.