New year, new FED guidance

The last time we talked, the Federal Reserve was busy addressing one half of its dual mandate: full employment.

Generally, when we see the FED in the news, it’s regarding things like interest rates or treasury purchases. But creating the monetary conditions for a healthy labor market is part of the job too. And boy did we need some help coming out of 2020, when nearly 15 percent of the workforce was suddenly laid off in April.

But after spending much of 2021 helping to reduce unemployment from 6.3 to 4.2 percent, it became necessary to address the other half of that mandate: managing inflation. November saw the highest CPI prints in more than a decade, and the grumbling we heard throughout the summer and fall has gotten quite a bit more urgent as we turn the calendar. After 18 months of trying to bring the economy back up to a low-simmer, it suddenly became time to turn down the burner before the pot got closer to boiling over.

2022 is likely to create some different market conditions and investment challenges, so I popped over to visit EdgeRock Portfolio Manager, Rob Foss, to give us an outlook for what lies ahead.

***

Well, we made it. It’s 2022. That means everything starts fresh, right? No more 2021 problems, right?

But seriously—markets always feel like they circle the wagons a little bit in December. Is there anything we can glean from calendar cycles? And what do you think the institutions and money managers have been gearing up for this coming year?

I think you and I agree that Gregorian calendars are a bit arbitrary. However, the end of the year can have some significance considering this is when tax loss harvesting occurs, funds payout distributions, etc.

For individual investors, it provides a convenient time to evaluate goals for the upcoming year and make adjustments to financial position. Institutions are most likely evaluating manager performance, near term and long term spending needs, allocation, etc. However, funds are known to window dress a bit. This is when managers change out losing investments for other positions to try to improve the appearance of a funds performance before disclosing it to clients or limited partners. Window dressing happens on a quarterly basis as well.

As for what institutions and other managers are thinking about, it probably depends on the purpose of the institution or specific strategy of the manager. I’m guessing that areas of interest are the effects of the Omicron variant on macro/micro economic conditions and positioning in the face of the Federal Reserve tapering bond purchases before interest rate hikes.

Well, let’s talk about the Federal Reserve. They seem to be making quite a bit of news right now, both with the labor market conditions they’ve helped create and the monetary policy they expect to implement in the coming year to address inflation. What actions are they expected to take? And over what time period?

I think the FED has communicated clearly that they will be done with tapering by mid-year. I think what is still uncertain is the timing of rate hikes. In November, it was estimated that the FED will hike once this year in Q4. Now the thinking is we might get up to three rate hikes in 2022. The risk the FED is weighing is increasing rates to a much higher level too quickly. In theory, once rates increase over the level of growth, economy could be thrown into a contraction.

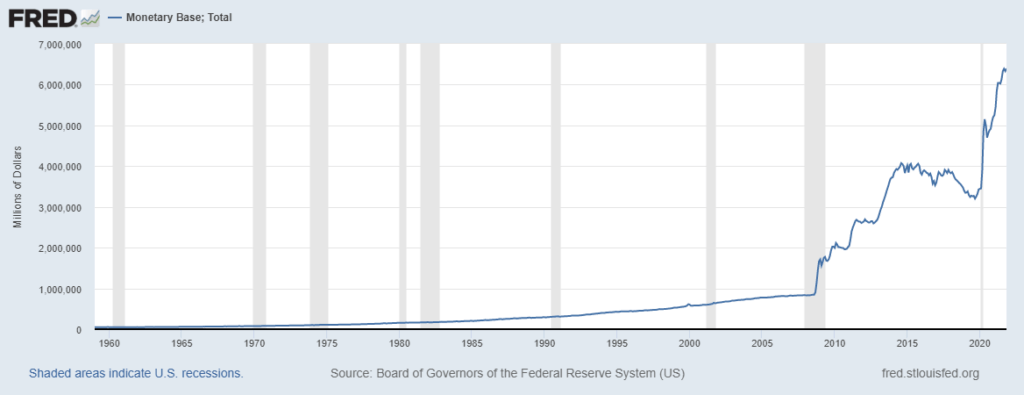

In addition to tapering, we’re also now hearing chatter about the FED reducing its balance sheet. What do they mean when they say this? Is there any historical precedent?

The FED can reduce its balance sheet by selling securities it previously bought back to its primary dealers (major financial institutions) or by not reinvesting the proceeds once those securities mature. Both actions take money out of the banking system, which is contractionary. There is historical precedent as the FED did let securities it held mature in the middle of the previous decade. Now, there is also some discussion over whether the FED will manipulate run off in some way so that too much money does not leave the system so quickly. The risk to investors is if the FED tightens monetary conditions too quickly and throws the economy into a contraction.

So how do these decisions affect the average investor? Are we going to see a lot of volatility or negative effects from the Fed tightening the reins a bit? Will any of it affect retirees in a particular way?

Interest rates affect all investors. Rates on mortgages, car loans, and other consumer borrowings are all implicitly based on FED decisions via fed funds rate and open market operations.

We’ve seen in the past that markets do get a bit more volatile as the FED tightens. Usually, markets do well during the early innings of a tightening cycle, but it’s also possible we get a bit of a drawdown, like we experienced with the taper tantrum or with what occurred in Q4 2018. However, I think its important to note that these events were short-lived.

Ultimately, I recommend that clients and all investors revisit their risk tolerance, account allocations, and the goals for each of their accounts. If these factors are appropriately considered, there is never any reason to panic.

Retirees are affected like all investors, but perhaps more severely than those who are working age. First, loss of purchasing power due to inflation is significant. Even on the precipice of rate hiking cycle, it’s important for retirees to have some exposure to growth. A small exception is if inflated dollars are being used to pay off an existing debt. That is a bit of a silver lining.

However, retirees also must be aware of sequence-of-returns risk. This is the risk that market declines in the early years of retirement along with ongoing withdrawals could significantly impair the longevity of their investment accounts. However, this risk can be mitigated through goals-based planning and asset allocation.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com or by calling (303) 780-7350. EdgeRock is not a broker dealer.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Newsworthy

Newsworthy

Newsworthy

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.