What the future holds for taxes

By Ryan Murphy

Director of Marketing

They say death and taxes are the only certainties in life, but just as inevitable is how those taxes evolve and change.

For as long as lawmakers have convened in Washington, there have been competing ideas about how to fund the federal government. And when there’s a shift in power, different visions for the country get implemented. We saw major changes in 2017 with the Tax Cuts & Jobs Act (TCJA), legislation many described as the most significant modification to the country’s tax code since the 1986 tax reforms.

And while most of the major concessions were awarded to corporate filers, plenty of individuals also saw a reduction to their annual tax obligation. Rates were slashed across every tax bracket, the estate tax exemption rose to $11.2 million, and the standard deduction was doubled for both couples and individuals (eliminating the need to itemize for most Americans in order to receive the biggest deduction).

But that was four years ago. The White House and both chambers of Congress are now controlled by members of the opposite party, and it’s probably reasonable to expect some change. But what kind of change exactly? And how might these decisions affect your investments and retirement savings?

Here’s what we’re hearing:

Tax increase for the top bracket

When President Biden took office, he promised to not raise taxes on individuals earning less than $400,000 a year. So far proposals out of the White House appear consistent with that promise, but there’s a high likelihood the top rate ($500,000 and up) should climb from the current rate of 37 percent back to the pre-TCJA rate of 39.6 percent. More importantly, the itemized deduction cap at 28 percent, which should have a greater impact on top earners than the nominal rate increase.

Reduced estate tax exemption

Prior to the 2017 Tax Cuts & Jobs Act, the estate tax exemption was $5.6 million per individual. Today it’s $11.2 million — and unlikely to stay that way. We expect the exemption to return to something close to its original figure, and that’s something families should keep an eye on. While $5.6 million might seem like a high threshold, when you factor in the value of a home, rental properties, valuable collections, and carefully invested retirement savings — anything that can comprise an estate — that suddenly affects a lot more families if they’re not prepared.

RMD age increase

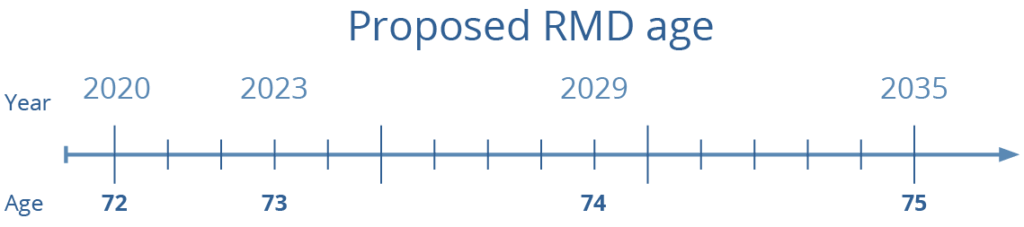

In 2019 the SECURE Act raised the mandatory Required Minimum Distribution age from 71-and-a-half to 72, which felt, at the time, like a necessary simplification rather than a substantive concession to retirees. There are two bipartisan bills making their way through both the Senate and House chambers seeking to take that idea even further. The House bill would immediately raise the age we need to begin withdrawing from tax-deferred accounts to 73 in 2022. After that, it would then automatically increase to age-74 in 2029 and then again to age-75 in 2035. The house bill would also eliminate RMDs entirely for those with less than $100,000 in aggregate savings and reduce the penalty for forgetting to file from 50 percent to 25 percent.

Expanded catch-up contributions

There are two competing bills in Congress seeking to expand the dollar amount you can contribute to a 401(k) or IRA. Current law allows anyone age-50 or older to contribute an extra $6,500 per year in a 401(k) account or $1,000 into an IRA. Both bills look to both expand the 401(k) catch-up contribution to $10,000 for those age-60 or solder, and then tie that figure to rate of inflation. This is welcome news for prospective retirees looking to maximize their savings during those final years of employment.

Capital gains taxed as ordinary income

As it stands, when you sell an investment held for longer than a year, it’s taxed as a long-term capital gain. That means it’s taxed at a zero, 15 percent, or 20 percent rate (before the 3.8 percent Medicare surtax) depending on income and filing status. That is different than short-term investments, which are taxed like ordinary income. What’s currently being proposed is taxing long-term capital gains at the 39.6 percent top rate if a filer’s income exceeds $1 million.

Increased dividend tax rate

Like capital gains, dividends are currently taxed at a lower rate than ordinary income if held for a sufficient amount of time. The current rate of zero, 15 percent, or 20 percent rate, depending on income and filing status, is likely to increase to the new proposed top rate of 39.6 percent for those earning more than $1 million of income. Those “set-and-forget” dividend stocks might not be so forgettable anymore if you’re earning significant income from other sources.

Eliminating the Step-Up Basis

Right now, when one inherits an asset like stock or a home, the beneficiary can avoid capital gains taxes on up to $2.5 million of appreciated value upon liquidating the asset. This concept is called “step-up basis,” and it could be on its way out of the tax code. There is a provision in the American Families Plan to now apply capital gains taxes to appreciated value north of $1 million from original purchase. What that can mean is a cherished family home or long-held bloc of Apple or Walmart shares could be subject additional taxation.

EdgeRock Wealth Management is a registered investment advisor. Registration does not imply any level of skill or training. Information presented in this website is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk including possible loss of principal. EdgeRock Wealth Management does not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. Past performance does not guarantee future results. Different types of investments involve varying degrees of risk and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Newsworthy

Newsworthy

Newsworthy

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.