What to Expect When You’re Expecting Inflation

By Ryan Murphy

Director of Marketing

In his address to the media two weeks ago, Federal Reserve chairman, Jerome Powell, acknowledged inflation concerns but remained unwavering in his commitment to low interest rates in the face of still-high unemployment.

“We’ve still got a lot of people who are out of work,” Powell said in his news conference following the Fed’s two-day policy meeting. “We want to get them back to work as quickly as possible, and that’s really one of the things we’re trying to achieve.”

Private sector employment isn’t generally the focus of a Federal Reserve chairman, but these aren’t ordinary times. And Jerome Powell, not being from a traditional economics background, isn’t an ordinary chairman. He’s staking his legacy—and shaping the future of monetary policy—by casting aside 40 years of regulatory orthodoxy and embracing the possibilities of a little short-term inflation.

“Some of the asset prices are high,” he went on. “You are seeing things in the capital markets that are a bit frothy. That’s a fact. I won’t say it has nothing to do with monetary policy, but it also has a tremendous amount to do with vaccination and reopening of the economy.”

Hopefully some of you “bought the dip.”

He also thinks some of the price increases you’re seeing might have as much to do with lingering supply chain inefficiencies as all the pent-up consumer demand unleashing itself upon our unsuspecting economy.

“These one-time increases in prices are likely to only have transitory effects on inflation,” he said.

In plain language, Chairman Powell is willing to let consumer prices exceed the central bank’s stated two percent inflation goal for a short while in order to get employment numbers back into an acceptable range. He’s making a calculation that the logistical factors making things like lumber and semiconductors scarce will subside before interest rates need adjusting.

Nonetheless, he’s got the finance industry tying itself in knots trying to predict the timing of the seemingly inevitable interest rate hikes. They have to be coming, right? Right?!

Well, maybe they are; maybe they aren’t—or not in the way we’ve seen in the past. Because it’s clear monetary policy makers aren’t following the old playbook.

But how does all of this affect markets, you ask? I sat down with EdgeRock portfolio manager, Rob Foss, to find out.

***

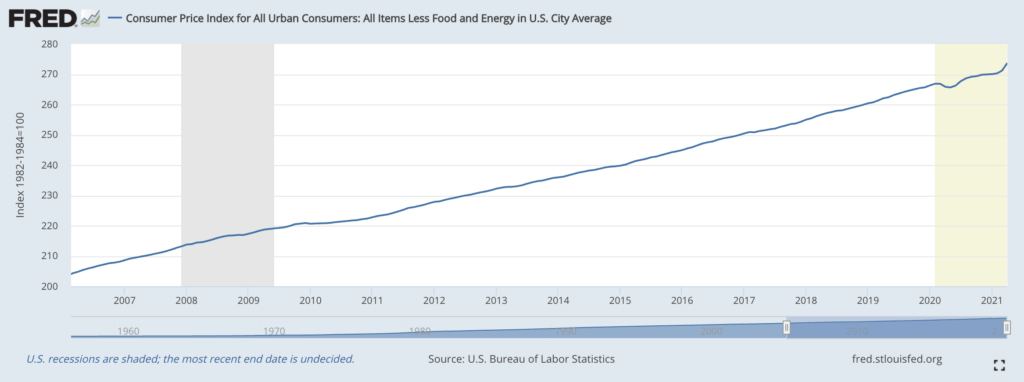

Ryan: The U.S. Bureau of Labor and Statistics hit us with a couple of reports in the last week that indicate a number of challenges our economy still needs to overcome. Setting the jobs report aside, let’s talk about the inflation we’re measuring in the economy. What do we need to know about the figures we’re reading?

Rob: The bottom line is a one-month snapshot isn’t going to tell us very much. Is a recent bump in the CPI the start of a new trend? Perhaps, but the answer is higher consumer prices are likely the result of a number of factors unrelated to monetary policy. Last year we saw widespread shutdowns in many manufacturing sectors, and that reduced output up the supply chain is now being felt as our economy begins to open up. Ultimately, this isn’t big news. It’s exactly what Jerome Powell said he was going to do: keep rates low and endure short-term inflation effects to jumpstart the economy.

Well, assuming some inflation might be our reality for a little while, what does that mean for everyone?

Well, in short—it’s reduced purchasing power. Your dollar simply won’t buy as much. But inflation isn’t felt in the economy uniformly. Someone trying to buy a used car or renovate their basement right now is going to experience price increases much more severely than those buying clothes or groceries. What does it mean for investors? The good news equity markets are usually a pretty good hedge against inflation. The worst thing you can do during a period of inflation is be sitting in cash or long duration assets. What’s important is for rate-of-return to exceed that rate of inflation. As soon it starts to outpace real growth, that’s when monetary policy needs to take action.

How does the possibility of a high-interest economic environment affect the way you manage EdgeRock portfolios?

Right now we’re closely monitoring the situation. The underlying data doesn’t suggest taking drastic action, but that doesn’t mean we shouldn’t be prepared. Our strategies overall are well-equipped to handle market inflation and we’ll always be looking for buying opportunities during these momentary dips. If the Fed does raise interest rates in the coming months to address inflationary concerns, that’s something we will adjust to as well.

Sometimes the transitory effects can leave a pretty big dent too. Where do things like hacked oil pipelines fit into the equation, and do we need to worry about these kinds of incidents having long-term impacts on prices when the economy is still in a tenuous state?

Data security is a growing concern for every business, including EdgeRock, because this kind of intrusion is likely to become more and more common. That said, it’s a temporary setback in the southeastern oil supply. Nothing the nation’s oil reserves can’t handle. Investors should know that these temporary buckles in the market due to panicked demand are not necessarily indications of inflation. I do think our clients should be extra vigilant with their credit statements. Do you have a credit monitoring service? Does your homeowners insurance policy cover data hacks? These are things we need to be mindful of in 2021.

EdgeRock Wealth Management is an independent firm helping individuals create retirement strategies using a variety of insurance and investment products to custom suit their needs and objectives. This material is intended to provide general information to help you understand basic financial planning strategies and should not be construed as financial or investment advice. All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information contained in this material is believed to be reliable, but accuracy and completeness cannot be guaranteed; it is not intended to be used as the sole basis for financial decisions. If you are unable to access any of the news articles and sources through the links provided in this text, please contact us to request a copy of the desired reference.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Newsworthy

Newsworthy

As the Ticker Turns

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.