Three Tax Deductions to Consider Before May 17

Filing taxes: Annoying.

Tax deductions? “We’re listening…”

Doing taxes is a chore. One-third of Americans complain it’s too complicated—and they’re probably right. If you think about it, the IRS already knows how much you owe and it’s up to you to guess. If you get it right, you might get a refund. If you get it wrong? Well, now there’s potential to get audited—and nobody likes being audited.

Doing taxes is a chore. One-third of Americans complain it’s too complicated—and they’re probably right. If you think about it, the IRS already knows how much you owe and it’s up to you to guess. If you get it right, you might get a refund. If you get it wrong? Well, now there’s potential to get audited—and nobody likes being audited.

Not a lot of people enjoy doing taxes. Nearly a quarter of all Americans (20-25 percent) file their taxes within the final two weeks they’re due. Luckily, this year, the IRS recently pushed the tax deadline back by another month to May 17th. You can now use this time to procrastinate even longer, or you can take advantage of this additional time to identify some less-common (and perhaps more beneficial) tax deductions than whatever you deducted for your car registration or home office you set up last year in your basement.

There are lots of deductions in the federal tax code, but let’s focus on three Kyle O’Dell highlighted during his latest Mile High Living segment on Denver7. (See video below.) Not to toot our own horn, but we’ve got some pretty good ideas up our sleeve.

Reminder: Make sure to consult a tax professional before making any final decisions. Each financial situation is unique and these suggestions may not be suitable for your specific needs. If you’d like more information or ideas concerning taxes, schedule a meeting with one of our advisors here.

There’s still time to contribute to an IRA

If you’ve had an IRA for any period of time, you likely already know the benefits of contributing pre-tax income to a retirement account. It’s a pretty useful tool that can help you maneuver between tax brackets. Only downside is you’re limited to how much you can contribute per year.

If you’ve had an IRA for any period of time, you likely already know the benefits of contributing pre-tax income to a retirement account. It’s a pretty useful tool that can help you maneuver between tax brackets. Only downside is you’re limited to how much you can contribute per year.

- $6,000 if you’re younger than 50

- $7,000 if you’re over 50

But if you didn’t meet that threshold last year, you now have another month to do so with the 2021 tax deadline extended to May 17. So maybe it’s worth going over those statements one last time. There might be an opportunity there you didn’t see a month ago.

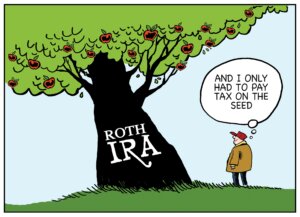

The same goes for converting IRA savings to a tax-free Roth IRA. This strategy will have the opposite effect, creating new taxable income on top of your other earnings. But income taxes remain historically low across the earning spectrum and you now have another month to decide whether this can benefit you in the long term. Not sure? Well, this is what a financial plan is for! Take advantage of this time to get your questions answered.

HSAs aren’t just about healthcare

Healthcare is expensive, and health insurance is often inadequate and frustrating. That’s why millions of Americans contribute pre-tax earnings to HSAs, or Health Savings Accounts, to pay for everything from eyeglasses and prescriptions to acupuncture and elective surgeries. But not as many people think about HSAs as a strategy to reduce taxable income. Like contributing to an IRA, every dollar you put into an HSA is a dollar you don’t have to claim as income to the IRS. And now you have until May 17 to do so!

There are rules, of course. You are typically only eligible through a high-deductible plan you get through your employer and you can no longer contribute once you become eligible for Medicare. And like IRA contributions, there’s an annual cap on the amount you and your employer can contribute to an HSA each year:

- $3,600 if you’re single

- $7,200 if you’re married

Tax deductions are great, but the benefits of HSAs don’t end there. Unlike the somewhat similar Flexible Spending Account, where you have to use-it-or-lose-it at the end of the year, you can use an HSA to accumulate and grow your savings through various investments tax-free. The earnings eventually need to be spent on medical expenses, of course, but it’s a wonderful resource for when healthcare costs become a significant concern during our retirement years.

Start thinking about estate planning now

Most of us put off these uncomfortable estate planning conversations as long as we can—and often until it’s too late. But Kyle O’Dell argues we should consider how you plan to pass money to your beneficiaries now. Why?

Most of us put off these uncomfortable estate planning conversations as long as we can—and often until it’s too late. But Kyle O’Dell argues we should consider how you plan to pass money to your beneficiaries now. Why?

Currently, the estate tax exemption is $11.7 million. That means every dollar passed down above that threshold is subject to a tax rate of more than 40 percent. Not too many families have that problem. But the estate tax exemption wasn’t always $11.7 million either.

The current administration is considering lowering that cap by more than 70 percent, somewhere closer to its more recent precedent of $3.5 million. When you consider the appreciated value of homes, investment properties, and untouched retirement accounts, that new threshold suddenly exposes a far greater number of families to estate taxes. How do you get in front of that? Kyle suggests taking action sooner rather than later—and until May 17, you can still take action for 2020. Let’s discuss a couple of ideas:

Begin gifting money to beneficiaries

Maybe you’ve already made a decision about passing money to children or heirs. Maybe you haven’t. But if that’s your goal, and you already have a financial strategy in place to cover your income needs, start thinking about disbursing those funds now. There is currently a $15,000 cap per beneficiary, per year ($30,000 if married and filing jointly), but no limit in the number of people to whom you can provide cash gifts.

Cut a check to a recent grad, help with the downpayment for a home, or make a regular deposit for favorite grandchild for calling you every Saturday—whatever you decide to do, the idea is to gradually pass down earnings to your loved ones before they become a burdensome lump-sum. Worried about creating tax problems for your beneficiaries? Want more control over how the funds are allocated? Let’s talk about creating a trust so that you can ensure your wishes are met.

Consider a Life Insurance Policy—for taxes

One of the trickiest assets to pass down is land or real estate. Inheriting the full value of a cherished family farm or home can add a crushing amount of income to a tax return. The resulting taxes are often so high, beneficiaries are often forced to sell these properties, which is rarely the intent of the estate. How do we avoid this kind of disaster? Well, have you considered a life insurance? Funding a properly structured policy now can later provide a benefit large enough to cover any taxes on your estate.

But these are just a couple of ideas. If you want to start a conversation, start by trying out our free Tax Checkup, which can identify up to 30 different inefficiencies in a tax return!

EdgeRock Wealth Management is an independent firm helping individuals create retirement strategies using a variety of insurance and investment products to custom suit their needs and objectives. This material is intended to provide general information to help you understand basic financial planning strategies and should not be construed as financial or investment advice. All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information contained in this material is believed to be reliable, but accuracy and completeness cannot be guaranteed; it is not intended to be used as the sole basis for financial decisions. If you are unable to access any of the news articles and sources through the links provided in this text, please contact us to request a copy of the desired reference.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Rock Talk

As the Ticker Turns

Rock Talk

Rock Talk

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.