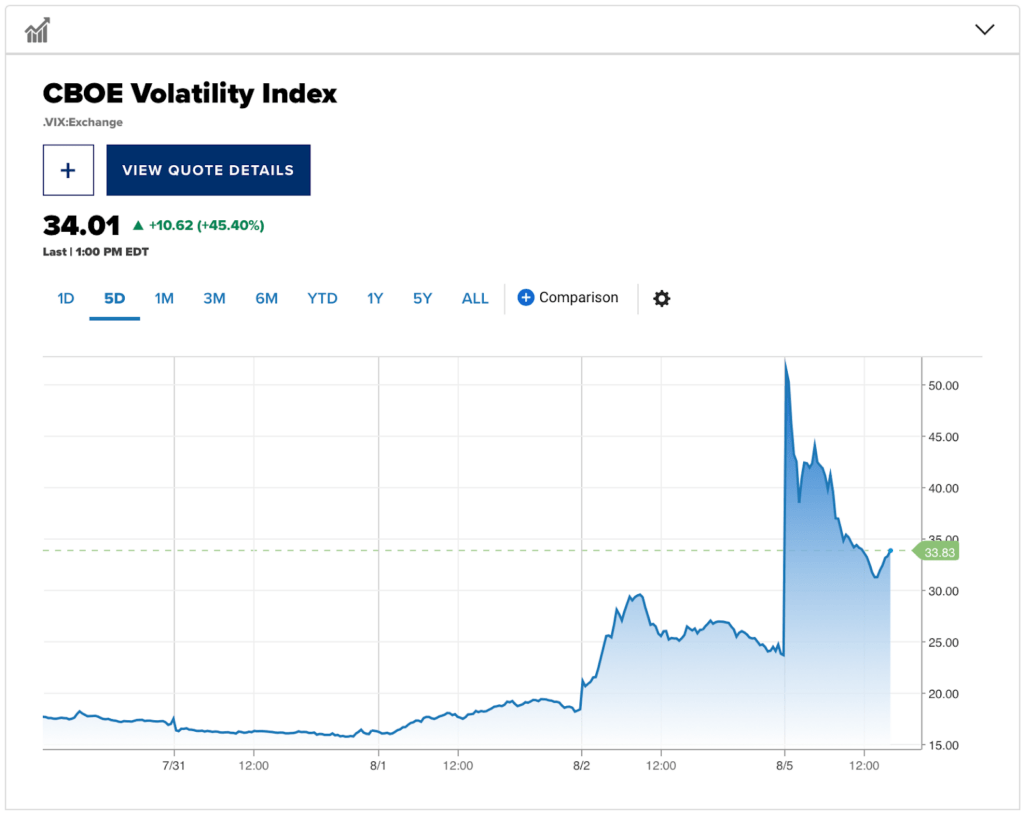

- The market volatility index is currently signaling duress

- The most recent unemployment numbers have triggered the Sahm Rule, typically an indicator of recession.

- Even Sahm, herself, says the rule might not apply during this market cycle.

The Sahm Rule trigger might not indicate recession

Every once in a while, it’s important to be reminded that markets are volatile and conditions can change very quickly. The past week is a great example.

The VIX, which measures the market’s expectation for future volatility based on options trading, sat at a very-low mid-teens figure as recently as last Wednesday. Anything under 20 generally indicates relatively calm conditions. On Monday, it shot up briefly to an extraordinarily high 65, a number traditionally associated with market duress.

Changes in volatility can happen for many reasons, including changes in economic indicators, market sentiment, political events, or external shocks. We believe the recent volatility is the result of the first two.

Last week’s unemployment report triggered the Sahm Rule. This indicator, named for its creator, renowned economist Claudia Sahm, compares the three-month moving average of the national unemployment rate to its minimum value over the previous 12 months.

Sahm observed in her working paper every breach of this threshold in the past has signaled the onset of a recession—though she’s been publicly cautioning this week now is not necessarily time to panic.

Still—investor sentiment seems to be getting more skeptical.

Earnings season is starting to tell a new story

In our 2024 Market Outlook, we pointed to concentration risk at the top of the S&P 500. This risk is still very much still present, as large “Magnificent Seven” stocks continue to comprise an outsized weight of the total equities market.

Valuations of these companies are currently high. So if investors decide they are no longer justified, a large sell-off at the top of the market could have a significant effect on the greater public equities market.

Could this actually happen?

Past the midpoint of the Q2 2024 earnings season, profits are good—but not great. Many companies are beating on top-line and bottom-line estimates, but the reward for beating expectations is much smaller proportionally than the punishment for missing expectations or presenting a weaker outlook.

Management commentaries—particularly in the financial and consumer discretionary sectors—warn that consumers are pulling back on spending or adjusting their spending habits, but are still in relatively good shape. We think that last week’s unemployment number could confirm what these commentaries have been telling us.

Despite these strong signals, it’s still extraordinarily difficult to interpret what it means for the near-term future of our economy and financial markets. We will certainly be keeping a close eye on these developments as they unfold and adjust accordingly.

In the meantime, our experience tells us individualized, well-diversified allocations designed to fit custom financial plans do relatively well in down-markets.

Just like they do in up-markets.