The 2024 EdgeRock Outlook

By Rob Foss

Chief Investment Officer

EdgeRock Wealth Management

Even if we don’t consciously think about it, the end of the year is significant.

Not only do we get time to celebrate holidays with family and friends, but we also take the opportunity to reflect on the year that was and ponder what might happen when the calendar turns. The same is true in the world of investing. While we don’t predict the future, and try to avoid hindsight bias; as stewards of financial plans and investments, we believe it’s important to add insight and context to what we believe is, or might be, important going forward for our clients.

Below are five things we’re thinking about as 2024 bears down on us.

- The Non-Magnificent 493

- Rate Hikes: Close to the End?

- The Triumphant Return to Value?

- What Lies Ahead: A 2024 Outlook

- Money Market Funds Aren’t the Answer

***

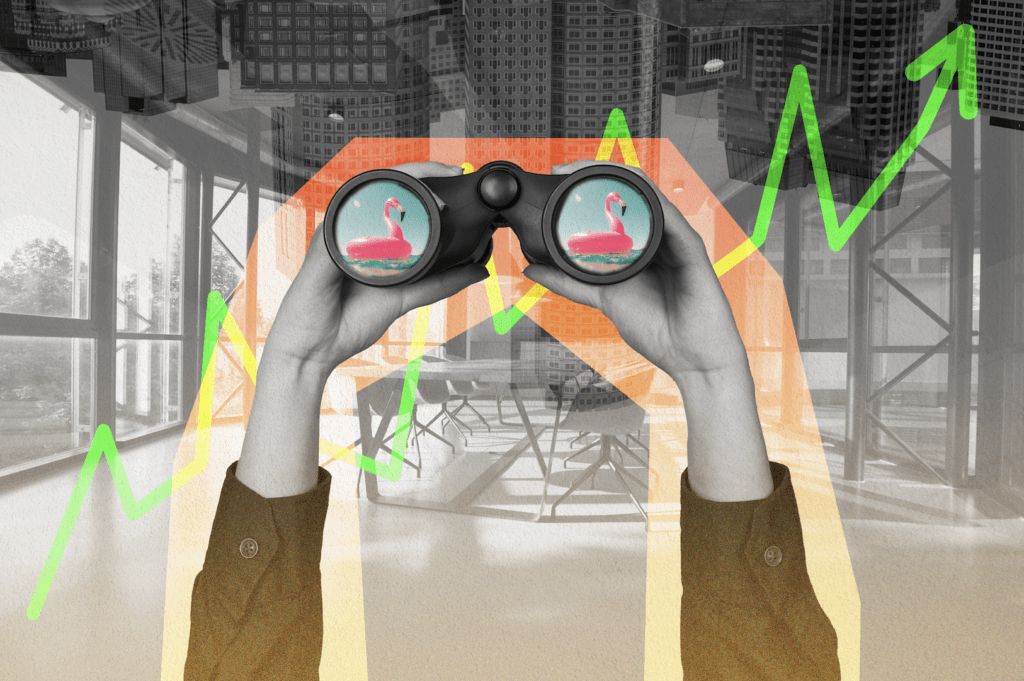

The Non-Magnificent 493

The Magnificent Seven (1960)

This past year, domestic equity returns were overwhelmingly comprised by the performance of the newly coined “Magnificent Seven.” These seven stocks carried the S&P 500 to a positive performance of 21.4% as of December 1, 2023. In comparison, the S&P 500 equal weight index (RSP – Invesco S&P 500 Equal Weight ETF) is up slightly. This implies the other 493 companies in the index have contributed a combined negative performance of -0.7%.

While positive returns are always appreciated, the lack of “breadth,” or number of contributors to this growth, is notable and could serve as a sign of caution. Breadth in the industry is generally defined by the number of stocks moving in the same direction, and is an indicator looked at by a number of technical analysts and stock market investors alike. If many stocks are moving in the same direction (up or down), the trend is viewed to be more sustainable than if a small number of stocks is driving performance.

We’ve never seen perfect market conditions. But without more companies participating in rallies, we will continue to view the recent growth in the market with some skepticism. We most likely won’t be chasing returns from here unless there are more fundamental changes in the macroeconomic environment. We prefer to stay diversified and balanced rather than recommending outsized positions based on a single risk.

***

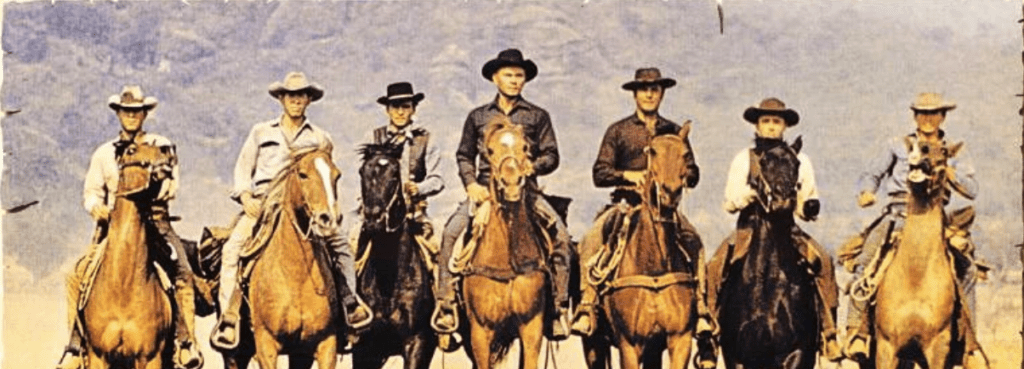

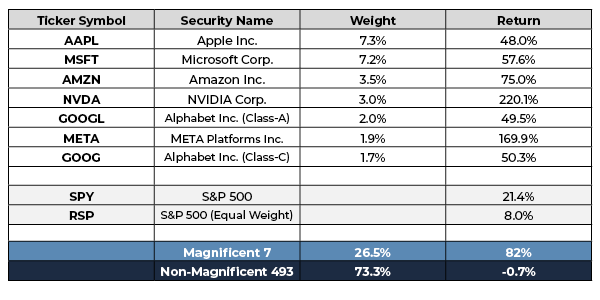

Closer to the end?

In 2023, the Federal Reserve hiked interest rates four times at 25 basis points to reach a target rate of 5.25-5.5. This is in addition to the seven rate hikes the enacted in 2022, six of which were more than 25 basis points. This was the fastest rate hiking cycle on record.

Image by Visual Capitalist

Without pointing to specific evidence, it’s reasonable to believe we are closer to the end of this rate hiking cycle than the beginning.

We are cautiously optimistic that we are at the end, but we know it could be a mistake to assume the FED is done. There has been nothing in Jerome Powell’s recent commentary that alludes to an end to the rate hiking cycle. Despite weakening headline inflation numbers, subsets like rent and owners-equivalent rent continue to be sticky. We believe, if inflation measures and wage growth do not continue their current downward trend, there is possibility the central bank could still hike more. Mr. Powell reiterated this message in his commentary on November 9 and the stock markets dipped hard as a result.

Market participants, who are overly exuberant by the potential of cooling inflation and a halt in rate hikes, is a pattern we’ve seen during this cycle. Market reactions like the one seen in November remind us adverse possibilities are not well-priced into the market—those being “higher-for-longer” or “higher-for-longer-until-something-breaks.” (i.e. Anything but a near-term soft landing.)

Think of this as “bad-news-equals-good-news” for risk assets until bad news really does equal bad news.

Market participants, right now, are betting on the FED reducing its policy rate in 2024, and neither the FED nor many of the major banks project a recession. This result would be welcome, but there is also a chance these assessments are not factoring strongly enough weakening consumer data.

The FED does not typically reduce interest rates unless the economy is in trouble. The last example of the FED lowering interest rates without the immediate threat of a recession is when they reduced the target rate three times in 1998 from 5.25 to 4.75 . A recession did not start until March of 2001 in conjunction with the burst of the dot-com bubble.

Like everyone else, we are hoping for a soft (or at least softish) landing. However, in keeping to our principles, we cannot predict the future, which is why we believe in balanced allocations. We believe our client allocations are well-equipped to handle any scenario and will always recommend changes as opportunities present themselves.

***

The triumphant return of value?

Interstellar (2014)

The growth-versus-value conundrum has been long-debated. The reason is because there have been time periods in which one outperforms the other, and, ultimately, money managers (and individual investors) strive for outperformance. However, much like many other aspects of investing, timing is almost impossible. Going back more than 23 years, growth and value are almost at parity.

The “lost decade,” or the investment period between 2001 and 2010, is a great example of an easily identifiable span in which value outperformed growth. This decade is, of course, also defined by recessions at either bookend.

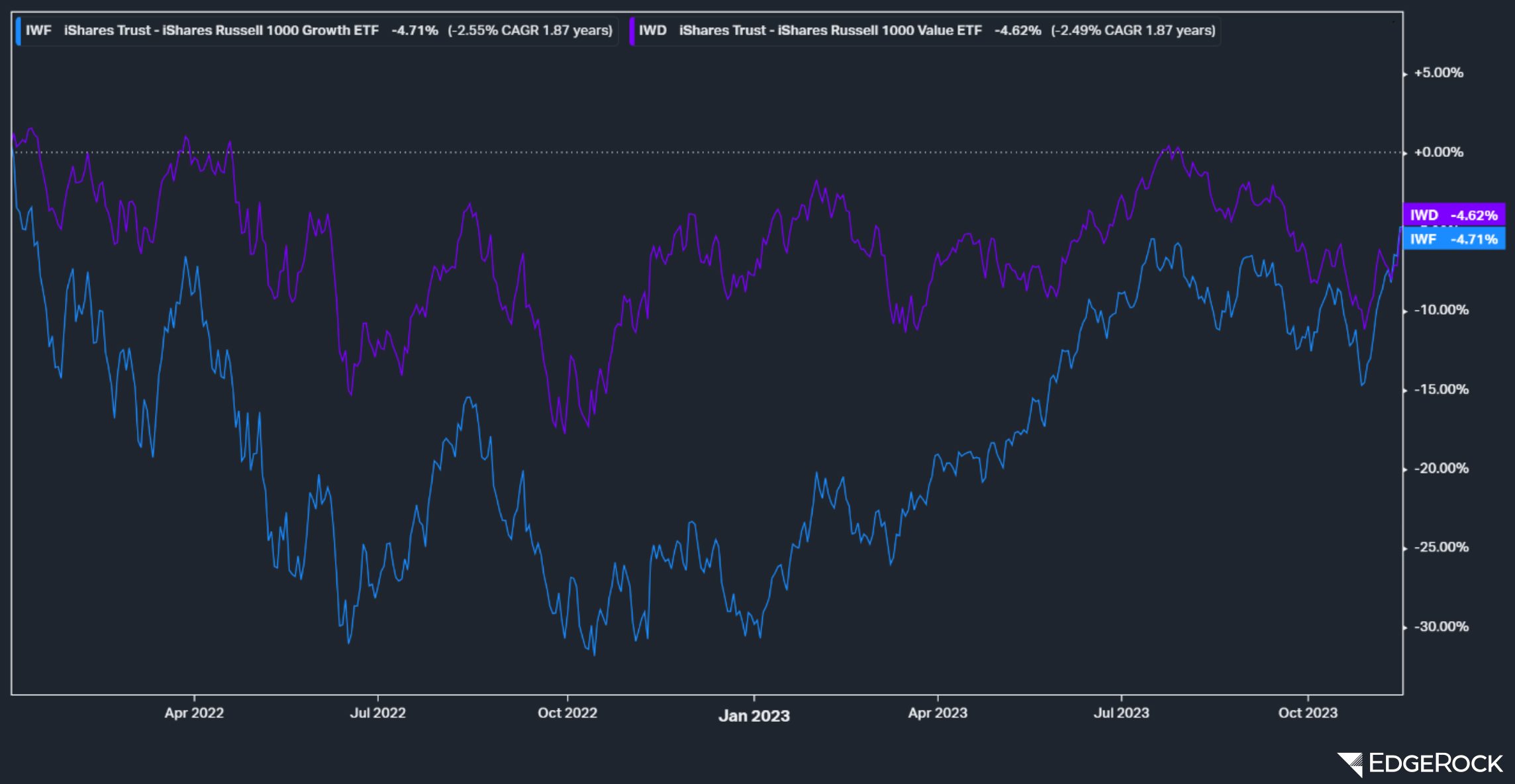

From 2015 through early-2020, large capitalization domestic growth was the place to invest. Active managers, and even passive instruments following different styles (value, dividend yield, small cap, international, etc.), were not viewed favorably. Per the chart below, it is easy to see why, as growth outperformed value by over 700 basis points annually during that period. It is widely accepted that the cause was interest rates being close to zero, which, in turn, inflates valuations. It should be noted that growth also outperformed value in the year or so directly after the onset of the pandemic.

From the beginning of 2022, when it became clear the FED was going to hike its target rate in response to not-so-transitory inflation, the reverse occurred, as value outperformed growth— albeit both down over the time period. The outperformance of value and other styles, such as small-capitalization and developed-international, led many to believe this was the beginning stages of a much-overdue comeback. The question on the top of everyone’s mind was: “What is the connection between higher interest rates and outperformance in these much maligned equity styles?”

Obviously, part of the story is the reverse of what was already mentioned: If interest rates come up, valuations must come down. This answer is only slightly satisfactory, as it would explain a one-time reset, or multiple compression, but does little to explain possible long-term outperformance.

When posing this question to money managers in those spaces, two common reasons emerge: (1) Valuations in these spaces are reasonable in comparison, which could drive more merger and acquisition-related activity, or (2) The slight unwinding of globalization, with increased regional spending. Aforementioned geopolitical events, and increased tension with countries such as China, have made numerous companies reconsider location of their supply chains.

Despite these views, EdgeRock has not materially altered our allocations. Specific time periods do not make a trend. More momentum in these spaces is needed to justify a change, as the potential upside to being a first mover does not always outweigh the risk. Valuation alone is not a catalyst. Eschewing growth for value disregards the reality that companies classified as value tend to have lower long-term growth rates (akin to that of GDP) and a larger subset of them are price-takers.

As professional investors, we still prefer companies that can set prices in any market cycle and realize premium companies—those that have higher margins, cash flows, and grow faster than GDP—will always be well-rewarded by market participants. Not to say that chasing returns is a good idea, but if the prospect of faster growth did not reward investors, asset classes like venture capital would not exist. Additionally, doing so ignores the concept of technological progress which produced productive gains through tools like the internet and now artificial intelligence.

***

These aren’t the investments you are looking for…

Star Wars (1977)

An overwhelming benefit of interest rate hikes are individuals, families, and institutions are now being paid relatively well for keeping cash on the sidelines. The target rate has not been this high since before the great recession. This has tempted many to depart from long-term investment allocations in favor of certainty at 5%. Academically, and in practice, a significant increase in the risk-free rate does necessitate a review of asset allocations and some movement, as the resulting risk premiums of various asset classes has certainly changed. However, a significant departure from a long-term strategy is akin to trading the forest for the trees.

Keeping a material amount of money in money market funds (outside of emergency funds and near term cash needs) means that you are betting on rates being the same or higher for an indeterminate amount of time, preferably long-term. This could happen but there are more scenarios in which this won’t happen. In fact, many fixed income investors are betting against it as judged by federal fund futures, which is something of which to take note.

If rates decline within a year, returns of just over 5% won’t be realized. 5% annually will be realized up until the points at which rates drop, so it will be more of a weighted average. Not to mention the fees on money market funds and ordinary income tax rates. The net after-tax return of these vehicles will be much lower.

The yield curve inevitably moves, sometimes in ways that aren’t foreseen. There will be a time, if it has not arrived already, where it is beneficial to lock in a slightly lower rate for a long-term horizon to accommodate slightly for reinvestment risk. Similarly, there will be a time in which credit spreads will provide an opportunity to take credit risk where investors will be rewarded not only with income, but with capital appreciation as well. These moments are why we recommend active management in the fixed income space and implore individuals and households to stick with long-term allocations. The short-term motivation to dump a lot of money into money market funds is a direct mismatch with the long-term perspective need to be a true investor.

***

What lies ahead: A 2024 Outlook

Our clients know we do not attempt to predict the future, and therefore won’t prognosticate financial markets for the coming year. However, there are several items we can discuss with relative certainty.

U.S. Elections and geopolitical events: Much ado?

We are asked a lot of questions about election cycles and their effect on financial markets. We believe that elections are vital for our democratic government. We also acknowledge that fiscal and tax policy can have a tremendous effect on legacy/financial planning. However, their effect on the prices of risk assets is anything but straightforward. While election cycles can introduce uncertainty, historically and over longer-term time horizons, the performance of the stock market is influenced by macroeconomic factors, corporate earnings, and global market conditions. Our political system typically ensures a degree of continuity in economic policies, mitigating drastic shifts that could affect stock prices. Market reactions to elections are often temporary.

Baring something unforeseen, we don’t believe this election cycle will make us materially alter our allocation decisions.

Around the world

Similarly, geopolitical events have an uncertain link to market returns. Markets often display a degree of resilience, as investors may already have factored in a certain level of geopolitical uncertainty, as with the Russian-Ukraine war. It is important to note that many economic indicators related to Europe were starting to sour before war broke out between Hamas and Israel. The interconnectedness of the global economy means that while certain regions may be affected, others might experience relative stability, contributing to a balancing effect. Regardless, we have not typically recommended a large over seas allocations regarding client allocations and we most likely won’t being doing so in 2024. We continue to believe that the U.S. has the strongest and deepest financial markets. Not to mention that global exposure is gained in existing recommendations as many of the S&P 500 constituents generate revenues worldwide. If anything extreme were to happen, we anticipate central banks and policymakers would employ measures to stabilize markets, providing a buffer against extreme volatility.

***

As always—we’re here for you

The investment landscape can (and will) change. That’s the purpose of an advisor relationship. When something shifts in markets, world events, or even your life at home, we want to be a resource you can count on to position your investments for what’s next. So don’t hesitate to lean on our team when you see or hear something that’s concerning doesn’t make sense. That’s what we’re here for.

See you in 2024.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

As the Ticker Turns

Rock Talk

Rock Talk

EdgeRock Updates

Uncategorized

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.