Social Security Benefits: When to Start Collecting

Social Security (SS) plays a vital role in many of our clients’ retirement income plans. In fact, it’s estimated that up to 40 percent of retirees count on Social Security for up to 90 percent of their retirement income. With this fact in mind, it is critical to consider when is the best time to begin taking your Social Security benefits.

Understanding Your Options

There are hundreds strategies available when considering starting Social Security. You can elect to begin Social Security as early as age 62, or you can elect to delay Social Security income all the way out to age-70. Do you begin collecting Social Security early to receive benefits for the longest possible period, or do you delay starting, allowing your benefits to increase and ultimately collect a higher monthly amount? Deciding when to start Social Security can be material to the success of your retirement income goal. Starting early allows for a longer duration of benefits, but it comes with a trade-off—a reduced monthly benefit compared to waiting until Full Retirement Age (FRA) or even later.

The Benefits of Delaying

For every year that you delay taking Social Security income from age 62 to FRA (typically between age 66-67) you receive a guaranteed annual increase of roughly 6.667 percent to your Social Security income. For every year you delay after FRA, that guaranteed increase rises to eight percent! Of course, now you have to live longer to be able to make up that gap for delaying Social Security income until age 70. Well, how long do you have to live, then?

At EdgeRock, we’ll run a detailed analysis of your individual Social Security situation and help determine the optimal strategy for you.

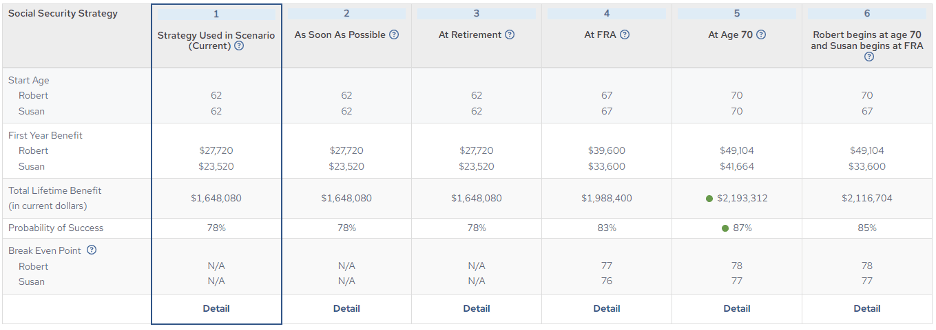

Case Study: Robert and Susan’s Strategy

In the scenario above, Robert and Susan* are both 61 years old, and both are retired. We assumed a life expectancy of age 95 for both. Robert and Susan had always thought that starting Social Security income as early as possible was always the best plan. We simulated a number of Social Security start strategies for both Robert and Susan, and discovered in their case, delaying Social Security until age 70 resulted in the best strategy for the two of them, increasing their lifetime Social Security payouts by over $540,000, while also increasing their probability of retirement success by 9%!! Further, Robert and Susan only had to live until ages 78 and 77 (respectively) to start collecting more Social Security income over their lifetime than if they started Social Security at age 62.

Finding Your Optimal Social Security Benefit Strategy

At EdgeRock, we focus on creating personalized Social Security analysis to help you determine the optimal strategy tailored to your unique circumstances. Whether you’re nearing retirement or already retired, our detailed analysis ensures you make informed decisions to help maximize your Social Security benefits.

Deciding when to start receiving Social Security is a pivotal decision affecting your retirement income. By carefully weighing the advantages of starting early versus delaying, based on factors like life expectancy and financial goals, you may potentially enhance your financial security in retirement.

If you’re unsure about the best Social Security strategy for your situation, reach out to us at EdgeRock. We’re here to provide expert guidance and analysis to support your retirement planning journey.

*The case study presented in this blog is entirely fictional. Any resemblance to real persons, living or dead, or actual events is purely coincidental. This example is intended for illustrative purposes only and does not represent any real individual’s specific circumstances.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Uncategorized

Newsworthy

Newsworthy

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.