The FED holds steady again. Are 5.5% interest rates here to stay?

By Rob Foss

Chief Investment Officer

EdgeRock

Last week, the Federal Reserve Board of Governors gathered again for its bimonthly meeting. Its members voted to leave the central bank’s target interest rate between 5.25 and 5.5 percent, which surprised no one closely tracking FED commentaries and FED fund futures.

The questions asked of Chair Powell during his press conference continued to center around the future path of interest rates. With parts of the economy still experiencing sticky inflation, Powell reiterated the FED was prepared to sustain its elevated target rate until their preferred inflation measures read much closer to their 2.0 percent benchmark.

He also rightfully scoffed at the idea of stagflation and political interference in FED decisions.

Macro policy: It’s for the birds

Whether you fall in the dove camp (those that believe rates should be lower) or in the hawk camp (those who believe rates should be higher), this press conference didn’t give anyone much to chew on.

Powell’s dovish commentary—no foreseeable need for another hike—was well-counterbalanced by plenty of hawkish language, making it known that an extended, or even undefined, timeline for higher interest rates could continue to be appropriate.

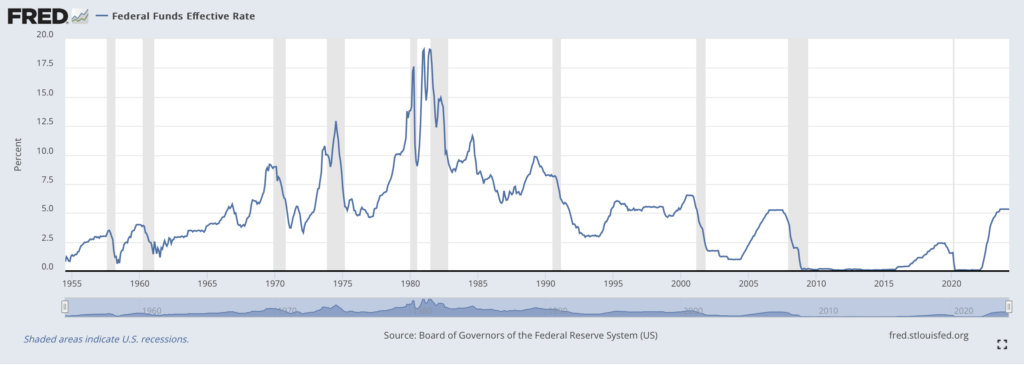

(One might also characterize this position as a normalization to historically common interest rate levels after being kept so low since The Great Recession in 2008.)

Continued higher interest rates make sense in our view. While inflation has cooled down considerably in many parts of the economy, it still isn’t at its target rate of 2.0 percent overall. The jobs market (unemployment rate & wage growth) has also cooled in recent months, but has also remained largely in good shape.

What we read from this is that elevated interest rates have not yet done significant damage to the economy. But leading indicators suggest that can change at any time.

The cracks beneath the surface

There is plenty of concern among pundits that the fight against inflation has stalled. Both CPI and the FED’s preferred PCE measure have flatlined in recent months after sustaining a consistent downward trend for all of 2023.

But other industry commentators have begun pointing to underlying measurements that are starting to buckle due to this restrictive policy stance.

Recent earnings reports and surveys of consumer spending have begun to signal lower socioeconomic tiers, at a minimum, are starting to spend more cautiously than they did a year ago.

Companies in this sector still reporting strong earnings have been attributing strong promotional activity and/or loyalty program improvements, but it’s possible these efforts will only produce a temporary effect.

So what does any of it mean, exactly?

While we can’t know exactly what FED governors are thinking, it is hard to imagine them not paying attention—at least at a surface level—to corporate earnings.

If they’re seeing the same slowing of consumer spending that we are, it’s likely they view the current elevated interest rates working as intended, without any need for additional hikes, which could slow growth unnecessarily.

So what does this mean for investors? The answer is probably not much.

We believe in well-diversified allocations because we have seen success with this strategy over multiple market and economic cycles. If this response seems unsatisfactory, it’s because it’s our job to look past the reactionary language of the news cycle and keep our eyes fixed on the long-term investment goals of our clients.

We have begun to observe value stocks start to outperform growth. However, this slight outperformance has not given us enough cause to deviate from our core positioning at this time. EdgeRock will continue to ensure client accounts are appropriately positioned to address current market and macroeconomic conditions.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Uncategorized

Newsworthy

Newsworthy

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.