The Best Order to Invest Your Money

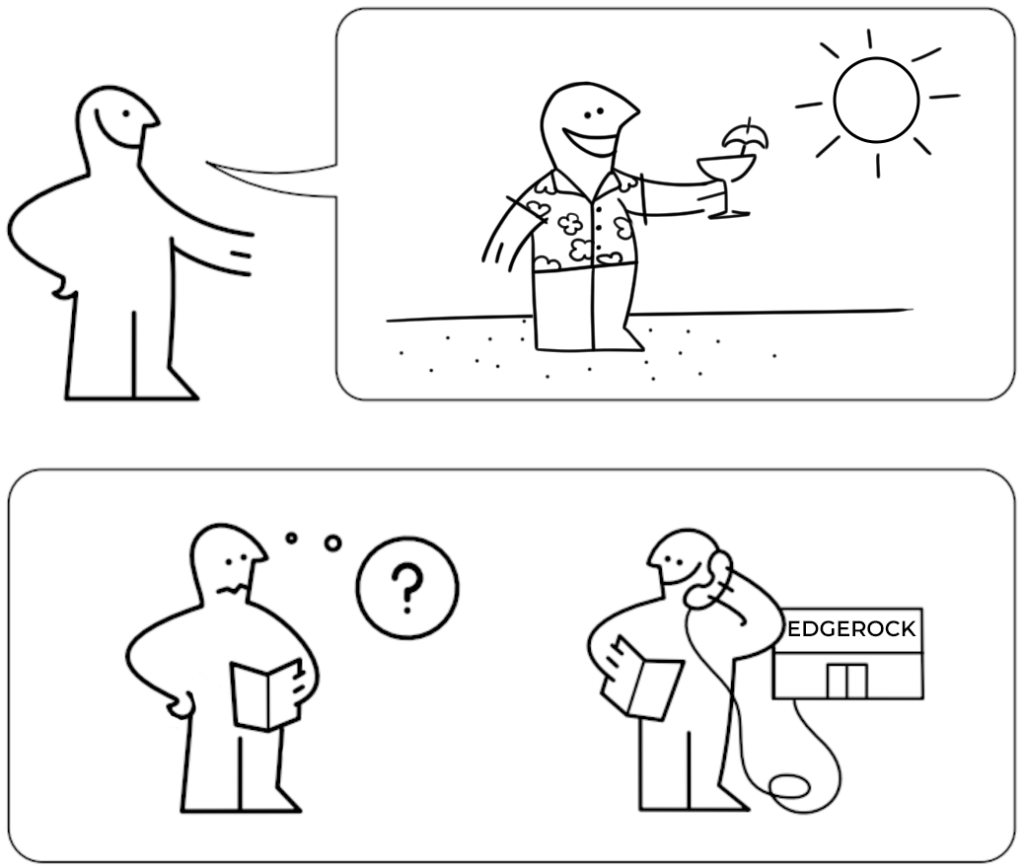

Navigating the world of investing can feel a bit like assembling furniture from IKEA: you have all the pieces, but the instructions seem to be in another language. This guide will help you make sense of the investing puzzle and put everything in the most efficient place. We’ll walk through the best order to invest your money, from how much to stow away in your 401(k) to venturing into Non-Qualified investments. So, grab a cup of coffee, and let’s build your financial future together!

Navigating the world of investing can feel a bit like assembling furniture from IKEA: you have all the pieces, but the instructions seem to be in another language. This guide will help you make sense of the investing puzzle and put everything in the most efficient place. We’ll walk through the best order to invest your money, from how much to stow away in your 401(k) to venturing into Non-Qualified investments. So, grab a cup of coffee, and let’s build your financial future together!

Invest Up to Your 401(k) Match First

One of the first steps in your investment journey should be to take full advantage of your employer’s 401(k) or employer-sponsored match. Many employers offer to match your contributions up to a certain percentage of your salary. It’s essentially free money, and who doesn’t love free money? By contributing enough to receive the full match, you’re making the most of your employer’s generosity and kickstarting your retirement savings with a significant boost.

Establish an Emergency Fund

Life has a funny way of throwing curveballs when you least expect them – that’s where an emergency fund comes in handy. Aim to save three to six months’ worth of living expenses in a readily accessible savings account. Brownie points if it’s a high-yield savings account! This way, whether it’s a surprise medical bill, a car that decides it’s had enough, or an unexpected job change, you’ll have a safety net to draw on without derailing your long-term financial goals.

Max out your IRA

Once you’ve secured your employer’s 401(k) match and have an established emergency fund, the next step is to contribute to an Individual Retirement Account (IRA). IRAs offer tax advantages that can help your money grow more efficiently over time, while allowing more flexibility in terms of investments and distribution options than a 401(k) typically will. Traditional IRAs might give you a tax deduction now, while Roth IRAs let you enjoy tax-free withdrawals later. Depending on your income and retirement goals, one may be more advantageous than the other.

Max Out Your 401(k)

Depending on your financial goals, the next priority for the best order to invest your money should be to maximize your contributions to your 401(k). Doing so will allow you to make the most of the tax-advantaged accounts you have available to you while also turbocharging your retirement savings. Think of it as adding that extra shot of espresso to your financial latte – more kick, more energy, and a more robust retirement plan.

Invest in Non-Qualified Investments

With your tax-advantaged accounts fully stocked, it’s time to venture into Non-Qualified investments. These are your regular, or after-tax, brokerage accounts that offer flexibility and freedom beyond retirement. You can use these investments for various goals such as buying a house, saving for a new car, or even taking your dream vacation. While you won’t get the special tax treatments here, the opportunity to enjoy greater liquidity with fewer restrictions make Non-Qualified investments the cherry on top of your financial plan.

The Best Order to Invest Your Money Can Be Different From Person to Person

Just like assembling that new coffee table, investing can seem daunting at first. But with the right guidance, it all starts to come together over time. Remember, everyone’s financial situation is unique, so while this is a great starting point, you may need to make some adjustments to fit your personal goals. So, grab your financial Allen wrench, and let’s turn that pile of parts into something sturdy that’s built to last!

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Rock Talk

As the Ticker Turns

Rock Talk

Rock Talk

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.