Roth conversions: A strategic approach to future-proofing wealth

At EdgeRock Wealth Management, we aim to help you make informed decisions that align with your long-term financial goals. One impactful strategy in today’s tax environment is the Roth conversion, which can offer significant lifetime tax benefits when executed correctly.

While many are familiar with traditional retirement accounts, like the 401(k) or IRA, the potential advantages of Roth conversions are less widely understood. Does a Roth conversion make sense for you? That will depend on your situation, but we find they’re almost always worth exploring.

Beyond potential tax benefits, let’s also delve into how Roth conversions can provide greater control over your financial future and serve as a valuable tool for tax-optimized legacy planning.

Why Consider a Roth Conversion?

A Roth conversion involves transferring assets from a traditional retirement account, like an IRA or 401(k), into a Roth IRA. You’ll pay taxes on the amount you convert now, but the benefit is your investments in this account will now grow tax-free. Withdrawals during your retirement years will also be tax-free. Doesn’t sound too bad, right?

Over your lifetime, this can result in substantial tax savings, making it particularly advantageous if your current tax rate is lower than what you expect in the future.

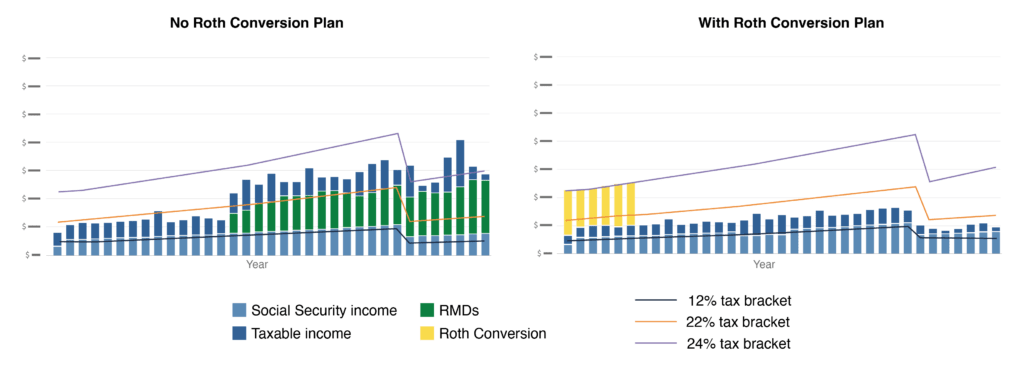

People often assume their tax rates will be lower in retirement, because they won’t be earning a salary. However, this overlooks several factors:

- Taxable Social Security Benefits: Depending on your other income streams, your Social Security benefits may become taxable.

- Required Minimum Distributions (RMDs): RMDs from traditional retirement accounts can push you into higher tax brackets, increasing your lifetime tax liability.

- Loss of Deductions: In retirement you may no longer benefit from deductions like those for dependents or mortgage interest.

- Change in Filing Status: Losing a spouse transitions you from “Married Filing Jointly” to “Single,” resulting in higher effective tax rates due to lower income thresholds.

By converting assets to a Roth IRA now, you can lock in today’s tax rates, reduce future taxable income, and provide flexibility that may lower your or your spouse’s future tax burden. This is the kind of clarity most families are seeking when we first meet.

Examples are provided for illustrative purposes only and do not represent actual client portfolios or accounts. There is no guarantee the examples presented will be achieved and actual client results may vary.

Tax-Efficient Legacy Planning

For most families leaving behind a legacy is important, but taxes can significantly reduce what you can pass on. Traditional retirement accounts are both subject to RMDs and must be fully distributed by non-spouse beneficiaries within 10 years upon inheritance, potentially increasing their tax bills due to increased income.

This erodes the value of your legacy over their lifetimes.

A Roth IRA doesn’t require RMDs during your lifetime, allowing you to grow these savings tax-free. And when heirs inherit a Roth IRA, even though they must still distribute the funds within 10 years, like a Traditional IRA, these distributions are not subject to taxation. This maximizes the value of what you leave behind and creates a more tax-efficient legacy, offering a similar lifetime tax benefits to your beneficiaries.

The Power of Control

An often-overlooked benefit of a Roth conversion is control. At EdgeRock, we want to ensure you have as much control over your financial future as possible. With a Traditional IRA or 401(k), you must start RMDs at age 73, increasing your taxable income and potentially affecting eligibility for tax credits or increasing costs like Medicare premiums. Over time, this can lead to higher lifetime taxes than anticipated.

Roth IRAs have no RMDs during your lifetime, giving you control over when and how much you withdraw. This flexibility allows you to manage your retirement income effectively, reduce taxes on Social Security benefits, and have a much finer set of controls on all things taxes. By strategically planning your withdrawals, you can optimize your lifetime tax situation.

The best time for Roth conversions is almost always now

At EdgeRock Wealth Management, we look to proactively manage your investments to optimize your lifetime tax benefits to pursue your financial future. While we’re not licensed tax advisors, we collaborate with strategic partners like CPAs and estate attorneys to tailor strategies like Roth conversions to your unique situation.

If you’ve used one of our strategies, please share this opportunity with friends or family who could benefit from a forward-thinking financial plan. Invite them to take the next steps toward pursuing a financial future by contacting us to schedule a conversation or join our upcoming speaking events.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

As the Ticker Turns

Rock Talk

Rock Talk

EdgeRock Updates

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.