Roth Conversion vs Roth Contributions: What’s the Difference?

When planning for retirement, Roth accounts often emerge as a powerful tool. They offer tax-free growth and tax-free withdrawals in retirement. However, not all Roth strategies are created equal. By understanding the nuances of Roth Contributions and Roth Conversions, you can optimize your retirement savings strategy and potentially unlock significant tax benefits.

What is a Roth Contribution

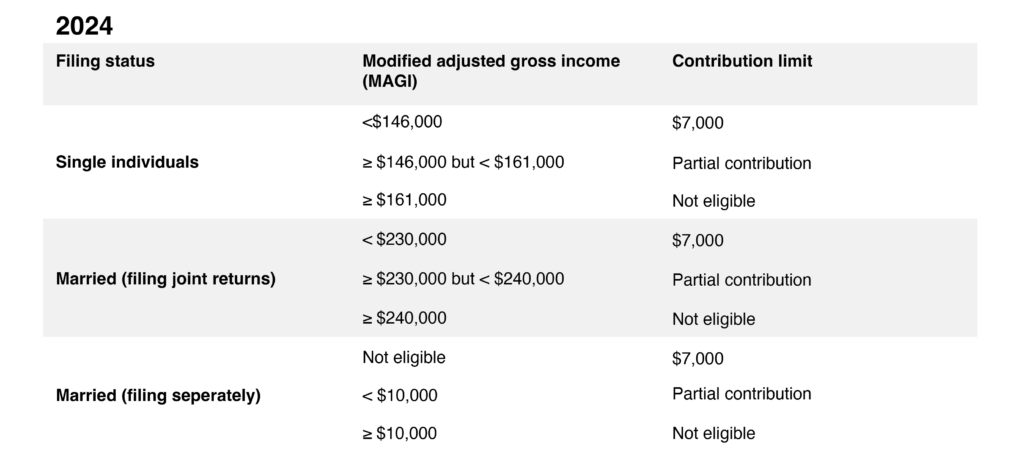

A Roth contribution is a powerful tool for retirement savings, allowing you to invest after-tax dollars and potentially withdraw your earnings tax-free in retirement. To make a Roth contribution, you must have earned income, such as wages, salary, or self-employment income. There are income limits for Roth IRA contributions, which vary based on your filing status.

For single filers in 2024, the phase-out range for Roth IRA contributions is between $146,000 and $161,000. This means that if your modified adjusted gross income (MAGI) is below $146,000, you can contribute the full $7,000 ($8,000 if age 50 or older). If your MAGI is above $161,000, you cannot contribute to a Roth IRA. For married couples filing jointly, the phase-out begins at $230,000 and ends at $240,000.

Roth 401(k) contributions have no income limits, but there is a maximum amount you can contribute to all of your retirement accounts combined, including your Roth 401(k), traditional 401(k), and other employer-sponsored retirement plans. This limit is set by the IRS each year. While you must have earned income to contribute, the funds can come from savings or other investment accounts.

What is a Roth Conversion

A Roth conversion involves moving funds from a traditional IRA or 401(k) to a Roth IRA. Unlike Roth contributions, Roth conversions have no income limits, meaning anyone can perform a conversion regardless of their income level. However, it’s important to note that a Roth conversion is a taxable event, meaning you’ll owe income tax on the amount you convert in the year of the conversion. The funds you convert must come from a pre-tax retirement account, such as a traditional IRA or 401(k), or from non-deductible IRA contributions.

When should you consider doing a Roth Conversion

You may want to consider a Roth conversion if you’re in a low-income year to minimize the tax impact, if you want to reduce future Required Minimum Distributions (RMDs) from traditional accounts, or if you want to diversify your retirement income sources by having both taxable and tax-free income.

Ultimately, the decision between a Roth contribution and a Roth conversion is a personal one. While both strategies offer tax advantages, they have distinct implications for your financial future. Consider your current tax bracket, anticipated future income, and long-term goals when making your choice. A Roth contribution can provide tax-free growth and withdrawals in retirement, while a Roth conversion offers immediate tax benefits and potential flexibility. To make the best decision for your specific circumstances, consulting with a qualified financial advisor is highly recommended.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

As the Ticker Turns

Rock Talk

Rock Talk

EdgeRock Updates

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.