Compound Interest: The Importance of Investing Early

Have you ever found yourself staring at your investment account, wondering, “Why am I even bothering with this? It barely seems to be growing?” It’s a common sentiment, especially when you’re first getting started with small amounts. But here’s the secret: compound interest is like a financial slow-cooker – it takes time, but the results are well worth the wait.

Compound Interest: The Basics

Compound interest is the interest on your principal amount (what you initially put in), plus any interest that was accumulated from previous periods. It’s like earning interest on your interest, and it’s a beautiful thing. Think of it as a snowball rolling down a hill – at first, it’s small and slow, but as it picks up speed and gathers more snow, it grows exponentially. The same principle applies to your investments.

Time: The Unsung Hero

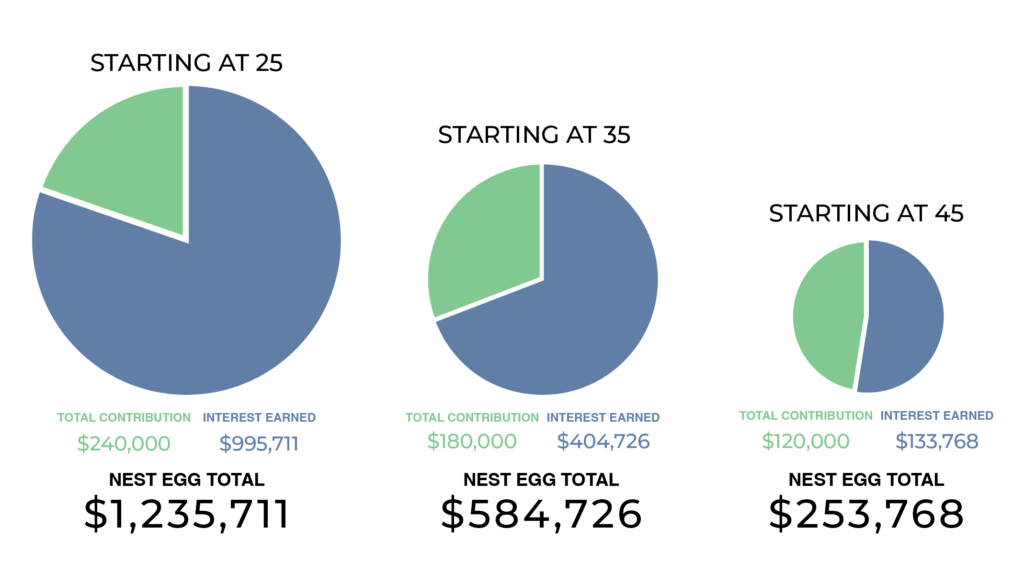

The key ingredient in the compound interest formula is time. The longer you let your money sit and grow, the more it has an opportunity to compound. Even if you start with small amounts, the long-term growth potential is significant. Let’s see how much of a difference delaying your investment start date can make.

Disclaimer: We’ll project the final investment value at age 65, using an investment calculator with the following assumptions: monthly contributions of $500 and an annual return rate of 7 percent.

Person A – Starting at 25:

Invest $500 per month from age 25 to 65 and you’d have a nest egg of $1,235,711. Your total contributions would be $240,000, meaning you earned over $995,000 in interest alone! Not too shabby, right? Let’s compare what this would be if you didn’t start investing until age 35.

Person B – Starting at 35:

Invest the same $500 per month but start at 35, and your nest egg would be $584,726 at 65. You contributed $180,000, with interest accumulating to just over $404,000. Not investing for those first 10 years cut your investment roughly in half!

What if you earn more later and save more?

Even if you plan to save more later, catching up is tough. To reach the same $1,235,711 at 65 but starting at 35, you’d need to contribute $1,056 per month – over double what Person A did!

Person C – Starting at 45:

Invest the same $500 per month but start at 45, and your nest egg would be $253,768 at 65. You contributed $120,000, with interest accumulating to $133,768. Delaying your investments for another 10 years significantly impacts your final amount! In order to match Person A ($1,235,711), you’d need to save a whopping $2,434 per month!

Time is not just an ally; it’s a game-changer! The earlier you start, the more your investments can snowball towards a comfortable retirement.

Avoiding the Pitfalls of Compound Interest

Of course, not all that glitters is gold. Compound interest is fantastic, but it’s not magic. It requires patience and consistency. The biggest mistake is withdrawing funds or losing focus. Remember, compound interest takes time. If you disrupt the snowball, it won’t grow as much.

Compound interest is a powerful financial ally that rewards patience and time. By investing early and letting compound interest do the heavy lifting for you, you give your contributions the best chance to grow into a substantial nest egg. The best things in life are worth waiting for, so embrace the power of compound interest and give your investments the time they need to flourish.

Remember: Consult a financial advisor for personalized investment advice tailored to your situation.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Rock Talk

As the Ticker Turns

Rock Talk

Rock Talk

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.