Is it too soon to feel optimistic?

By Rob Foss

Chief Investment Officer

EdgeRock Wealth Management

The Federal Reserve Board of Governors met this week in Washington DC for the final time in 2023. Afterward Chairman Jerome Powell addressed the media to share the board’s policy decisions.

No one was surprised to learn the FED would hold its target rate at 5.25-5.5 percent. Inflation continues to trend downward toward the central bank’s preferred rate of two percent. It’s clear they believe current policy is adequate for addressing the current condition of the economy. What caught market participants off-guard was the FED’s 2024 outlook, which included three rate cuts next year.

This confirms what fixed-income investors have been betting on now for several months. In fact, the Federal Funds Futures market is now pricing in a 98-percent probability the FED will cut its target rate by 25 basis points in March. This sparked a dramatic rally for risk assets in the days that followed.

What should this news tell us? Well, probably nothing definitive. (Yet.)

Reasons to be optimistic

- For better or worse, market rallies are great! I’ve never met a professional investor who doesn’t welcome them to a certain degree. (Unless they’re too busy trying to cover all their short/bearish bets, of course.)

- Financial markets are a leading indicator. So increased breadth (i.e. more stocks moving upward at the same time), as seen by the massive participation of small capitalization stocks, for example, is a good sign of sustainable, positive momentum.

- The consumer is still resilient. Spending increased by 0.3 percent month-over-month and over four percent year-over-year. This is important because consumer spending is still the most significant component of GDP. Also helping the consumer is the labor market is still generally strong. A strong consumer will only contribute to achieving a soft landing. If this scenario comes true, in combination with projected double-digit earnings growth for the S&P 500 for next year, 2024 could be a great year for domestic financial markets.

Reasons for caution

- A common refrain here at EdgeRock is the future is unknowable. The probability of a soft landing most likely increased this week, but is far from a certain outcome. We still think it makes sense to consider other, less optimistic scenarios when designing and implementing client allocations.

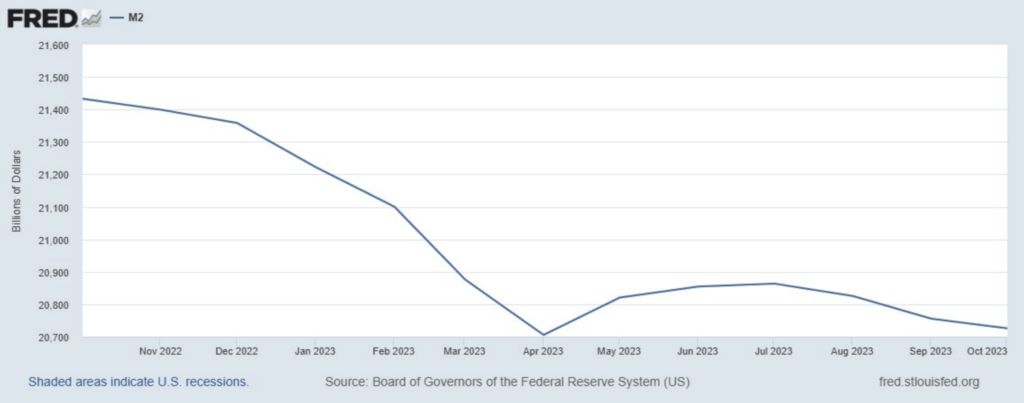

- What about quantitative tightening (QT)? While the FED’s target rate is front-and-center, the balance sheet run-off is still happening. The effects of monetary policy are long and variable, and in combination rate hikes (read: slowing real estate markets), we still don’t know how the balance sheet run-off will affect the economy and, in the end, the consumer.

- While market rallies are overall a welcome event, there is always a risk of chasing markets that turn out to be disastrous. After a very tough third quarter, markets have seemingly done nothing but move upward. The result right now is that markets are in a very overbought position, as determined by various technical indicators, which will not last forever. While not a prediction, we would not be surprised if the rally cooled a bit.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Rock Talk

As the Ticker Turns

Rock Talk

Rock Talk

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today.