GameStop, Stimulus, and the Uncertain Threat of Inflation

By Ryan Murphy

EdgeRock Director of Marketing

Three weeks ago was a strange moment in the world of financial news. If you weren’t familiar with rapid online stock trading platforms like Webull and Robinhood, chances are you heard a lot about them between January 26–29. That’s because these easy-to-use phone apps were being used by online communities to manipulate markets to an extent many industry experts didn’t previously believe was possible. The S&P 500 dropped nearly four percent during that three-day span and left investors of all kinds wondering whether their portfolios were safe.

Retail trading—or stock trading by individuals—is, by definition, not done at a volume that moves markets in any meaningful way. It’s always been possible to place an order for, say, the latest and greatest tech stock. But a single trade isn’t even a blip on the radar when the major institutions are executing between two and six billion trades per day on the New York Stock Exchange.

So what was different this time?

A whole bunch of individual investors got together in a network of online forums called Reddit and decided it would be fun to inflate the stock of a handful of downtrodden public companies. Why? Because they learned a number of hedge funds had bet (by staking short positions) these stocks would soon decrease in value. So when the stock prices rose, due to this coordinated flurry of online trading, those short positions then proceeded to lose a lot of money. Like a lot money. Melvin Capital, Citadel, and Point 72 wrote-off billions of dollars in losses and would need to be bailed out by their investors. (Often other hedge funds!)

In the days that followed, the incident was both celebrated as a victory over the malevolence of Wall Street and decried as a turning point in the safety of stock investing. But ultimately, it didn’t end up being that big of a deal. (Except to those Redditors who borrowed large sums of money to invest and didn’t jump ship fast enough.) Markets adjusted accordingly and had completely recovered by the next week, tacking to the steady upward trajectory they’ve been on since March of 2020.

So what just happened exactly? What does it mean for stock investing going forward? Are everyone’s retirement accounts safe from the nihilistic exploits of Reddit forums? I sat down with EdgeRock portfolio manager, Rob Foss, to make sense of it all and discuss some upcoming items that are likely to have a much greater effect on financial markets.

* * *

Retail investing isn’t new and activist investing isn’t new. So why did we see such an uproar over this recent development with Reddit and GameStop? Can you help give us some context for what happened? And how might this kind of activity affect retirement savings that rely on the growth provided from stock markets going forward?

Rob Foss: I really don’t know why the focus was on GameStop and a handful of other names. I think a similar type of event could have occurred with other companies due to chatter on another social media platform just as easily. It probably originated with a few individuals and then got much bigger akin to a snowball rolling down a hill.

Everyone needs to remember, in a limited time frame (say an hour or day), a stock goes up if there are more buyers than sellers, and a stock will go down if there are more sellers than buyers. It is really that simple. There can be more buyers than sellers or vice versa for many reasons. In this case, there were significantly more buyers than sellers because a bunch of Redditors and retail investors thought it was wise to purchase. I don’t know for sure but, if the genesis of this idea was to “stick it to institutional investors,” it was case simple case of market manipulation, a deliberate attempt to disrupt the free and fair operations of public equity markets.

The good news for our clients is that the market capitalization of these companies is relatively insignificant in relation to the overall equity markets, so our strategies were not affected. This would be a much larger issue if this type of activity were to happen to large- and mega-capitalization stocks in which our strategies are more exposed. However, it is much harder to influence the price of larger companies in this manner.

On the horizon is a third round of stimulus provided by the federal government—as much as $1.9 trillion by most accounts. Much of this money is earmarked to help small businesses, shore up state and local government budget deficits, and provide the necessary resources to deliver 330 million Americans a COVID-19 vaccine. But we’ll also likely see another round of direct stimulus to 85 percent of the country in the form of a $1400 check. Can you tell us what this might mean for markets? How much effect do these stimulus checks have on consumer spending and the economy?

Rob Foss: In theory stimulus checks should encourage consumer spending, which is good for the economy and then, in turn, financial markets. However, it’s been reported that many households are saving their stimulus checks rather than spending them, which is not good for the economy. Over the short-term, it is hard to say what effect stimulus checks will ultimately have on markets. Over longer time horizons, it should be a net positive as long as some of the money is spent. Healthy households tend to equal a growing economy, which then support financial markets. (Pretty much in that order.)

There’s been a lot of talk from pundits and economists about how much money is being spent by the government. For anyone that lived through the late-’70s and studied the economics textbooks created in its wake, inflation is never far from thought. But Jerome Powell and the Federal Reserve don’t seem to share these same concerns. We’ve lived in a low-interest-rate environment since 2008 and still struggle to meet minimum inflation targets. Do we really need to live in fear of significant compensatory taxes? And how are these sustained conditions likely to affect markets?

Rob Foss: I think the consensus among economists right now is that there is a bigger risk in doing too little than doing too much. This, in general, is why they also believe that the possibility of rapidly increasing inflation is a secondary concern.

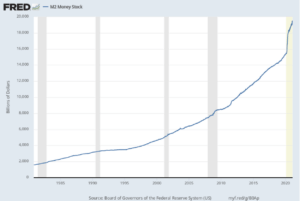

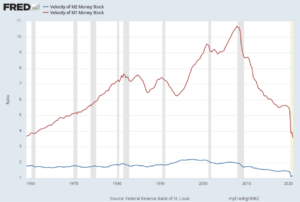

Here is my take, and I sincerely apologize to all economists: There has been a lot of print lately about the massive increases in the M1 and M2 money supply. Increases in the money supply, in and of itself, do not necessarily translate to inflationary pressures. I think there does need to be an increase in the turnover of this money supply, which is known as the velocity of money. This can be thought of, essentially, as how many times a single dollar gets used in transactions. The more times this dollar is used, the better it is for the economy.

In theory, inflation will increase dramatically if this same dollar is turned over rapidly. However, while the money supply has increased dramatically, it appears as if the velocity of money (turnover) has not increased. (See graphs below.) I am not an economist and this might be an oversimplification. However, for inflation to pick up, I think we need to see an increase in the velocity of the money supply. This has not happened yet, but it’s still something we need to keep an eye on.

EdgeRock Wealth Management is an independent firm helping individuals create retirement strategies using a variety of insurance and investment products to custom suit their needs and objectives. This material is intended to provide general information to help you understand basic financial planning strategies and should not be construed as financial or investment advice. All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information contained in this material is believed to be reliable, but accuracy and completeness cannot be guaranteed; it is not intended to be used as the sole basis for financial decisions. If you are unable to access any of the news articles and sources through the links provided in this text, please contact us to request a copy of the desired reference.

Advisory services are offered through EdgeRock Capital, LLC (“EdgeRock”), an independent SEC-registered investment advisor. Registration with the SEC as an investment adviser does not imply that EdgeRock or its owner or employees of EdgeRock possess a particular level of skill or training in the investment advisory or any other business. The firm’s disclosure documents (Form ADV 2 – Brochure, Privacy Policy, etc.) are available online at www.edgerockwealth.com. EdgeRock is not a broker-dealer. EdgeRock Wealth Management, LLC is an independent financial services firm that helps individuals, families and companies create strategies which use a variety of investment and insurance products to suit their needs and goals. Advisory services are provided by EdgeRock Capital, LLC, a SEC Registered Investment Advisor. Registration does not imply any level of skill or training. The information presented in this video is for educational purposes only and does not represent an offer or solicitation for the purchase or sale of any specific securities, investments, investment strategies, or insurance products or services by EdgeRock Wealth Management, or any other third party regardless of whether such security, product or service is referenced in this website or video. Investing involves risk of loss. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. Nothing in this website or video is intended to provide tax, legal, or investment advice. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation. EdgeRock Wealth Management, LLC links information provided by third parties to assist users in locating information on topics that might be of interest to them. Although the information presented is from sources we deem to be reliable, it has not been verified and is not guaranteed, nor can we attest to the accuracy of the information. Presenting information provided by a third party does not constitute a representation of the products or services offered by our firm and does it constitute an endorsement by our firm of the sponsors of the website or video or the information, products or services presented on the website. No consideration of any kind has been paid to or by EdgeRock Wealth Management, LLC or EdgeRock Capital, LLC for the information discussed on the website or in this video. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the needs of an individual’s situation. Please consult your financial advisor before buying or selling any security.

Latest Posts

Newsworthy

As the Ticker Turns

Newsworthy

As the Ticker Turns

Ready to Take The Next Step?

For more information about any of the products and services we provide, schedule a meeting today or register to attend a seminar.